Quote of the day

Eli Radke, “Admitting when you are wrong does not necessarily make you a better person. It does make you a better trader.” (Trader Habits)

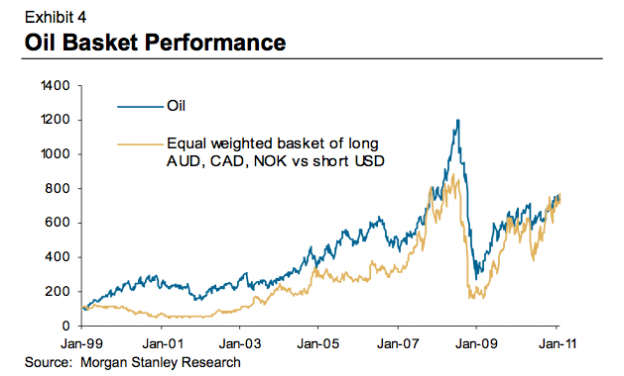

Chart of the day

Gaining oil exposure without ever buying a barrel. (Money Game via Pragmatic Capitalism)

Markets

Tom Petruno, “This may be the unhappiest bull market ever. We love to hate it, but that may be just egging it on.” (LATimes via Howard Lindzon)

What the top ten performing stocks YTD have in common. (ZorTrades)

Equity sentiment at week-end. (Trader’s Narrative, Pragmatic Capitalism)

Don’t look now but the financial sector are leading this market higher. (Dragonfly Capital)

Strategy

Jason Zweig, “The risks of owning stocks are real, and they are rising—not falling—as stock prices keep going up.” (WSJ)

Some thoughts on positioning a fixed income portfolio. (Seeking Delta)

ETF providers are trend followers. (Aleph Blog)

Companies

Starbucks (SBUX) could make a big splash in the single-serving coffee market. (Chicago Tribune via @herbgreenberg)

The age of Nokia (NOK) has passed. (GigaOM, WSJ, Daring Fireball)

Carl Icahn hearts Clorox (CLX). (Street Sweep)

Biglari Holdings (BH) really doesn’t want any small holders. (Peridot Capitalist)

Finance

Freescale Semiconductor once called one of the “ugliest buyouts in history” is now going public. (Dealbook)

A NYSE-Deutsche Borse hook-up may make for better execution, just not for individuals. (FT Alphaville also Barron’s)

Just how important is a “national stock exchange” these days? (Globe and Mail)

The long history of Fannie and Freddie in chart form and why it will be so difficult to kill them off. (MarketBeat also NYTimes)

How changing the down payment mandate could put mortgage insurers out of business. (FT Alphaville)

Investment banking MDs travel A LOT. (The Epicurean Dealmaker)

Pandora and profits

Profits aside, online music company Pandora files for an IPO. (GigaOM, Deal Journal, Dealbook, TechCrunch, SAI)

Being hip doesn’t necessarily make for a profitable public company. (The Reformed Broker)

You can’t build a sustainable business model on hype. (Stone Street Advisors)

Economy

The US has become a “lean, mean manufacturing (and exporting) machine.” (The Street Light, ibid)

How much is the decline the labor participation rate secular/demographic or cyclical? (Calculated Risk)

Gas prices have never been this high in February. (Mish)

It is hard to come up with an argument for rampant inflation. (macrofugue)

Tim Harford, “Don’t fixate on the financial crisis. Our economic problems have been far longer in the making, and would have caught up with us sooner or later anyway.” (FT)

Earlier on Abnormal Returns

Two smart fund managers both hold Brookfield Infrastructure Partners LP (BIP). Coincidence? (Abnormal Returns)

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Our Saturday long form links. (Abnormal Returns)

Mixed media

The ongoing battle between Google (GOOG) and SEO operators. (NYTimes)

The economics of blogging and the Huffington Post. (FiveThirtyEight)

Zack Miller talks with Mick Weinstein about the future of financial content, social media and investing. (Tradestreaming)

How your social media team can act as a ‘second brain.’ (Bigger Capital)

Thanks for checking in with Abnormal Returns. For all the latest you can follow us on StockTwits and Twitter.