Quote of the day

David Merkel, “Beware certainty in matters economic.” (Aleph Blog)

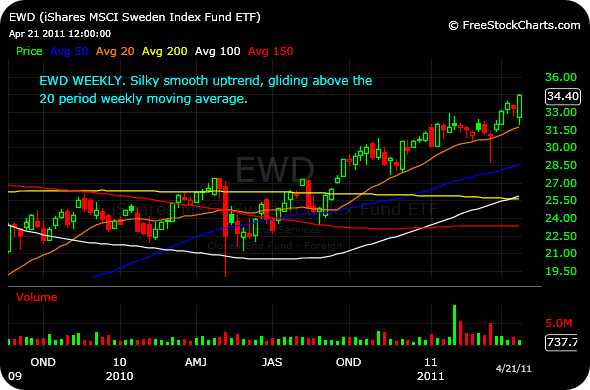

Chart of the day

Check out the Swedish stock market. (chessNwine)

Markets

Market sentiment at week-end. (Trader’s Narrative, The Technical Take)

Contrarian alert. Barron’s puts a bull crushing a bear on the cover. (Clusterstock)

The opportunity for investors in low option volatilities. (Barron’s)

Long grains. Short eggs. (WSJ)

Strategy

A stylized view of the equity/credit cycle and where we stand now. (Aleph Blog)

How to use Shiller’s widely reported upon 10-year trailing P/E ratio. (A Dash of Insight)

Why is everyone so worked up about the drop in the US dollar now? (Big Picture also WashingtonPost)

Time will tell whether today’s belief in silver as currency will hold. (Market Anthropology)

Jason Zweig, “Why would anyone pay $1.22 on the dollar for an asset that has already delivered blinding returns?” (WSJ)

Technology

Is Yahoo! (YHOO) finally going to deal? (SAI, AllThingD)

Just how big is the target market for tablets? (SAI)

Supply chain management is one of Apple’s true competitive advantages. (CNNMoney)

What “data-driven decision making” can mean to companies and the broader economy. (NYTimes)

Funds

Remember when the Fidelity Magellan Fund used to matter? (WSJ)

Actively managed ETFs: more of the same for investors. (CBS Moneywatch)

Hedge fund of funds are focusing on smaller, more specialized niches. (WSJ)

Finance

How Facebook has changed the secondary market for private company shares. (Businessweek)

Proxy season is pretty wacky for short term traders. (Dragonfly Capital)

Why hasn’t more been done to curb reverse takeover abuses? (Stone Street Advisors)

Global

The world is coming around to the idea that Saudi Arabia really doesn’t have much in the way of excess oil capacity. (Econbrowser)

How Brazil and China might react to continued currency appreciation. (Free exchange, ibid)

Germany is winning at the expense of the rest of Europe. (Money Game)

Economy

An FOMC preview. (Calculated Risk)

What exactly has QE2 accomplished? (NYTimes, naked capitalism)

How long will it take for home values to recover? (The Reformed Broker)

Earlier on Abnormal Returns

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Our Saturday long read linkfest. (Abnormal Returns)

Mixed media

Richard Thaler, “The ability of businesses to monitor our behavior is already a fact of life, and it isn’t going away. Of course we must protect our privacy rights. But if we’re smart, we’ll also use the data that is being collected to improve our own lives.” (NYTimes)

How today’s pirates differ from their predecessors. (The Technium also TRB)

Abnormal Returns is a founding member of the StockTwits Blog Network.