Quote of the day

Bob Lefsetz, “Ideas are a dime a dozen, execution is everything.” (Big Picture)

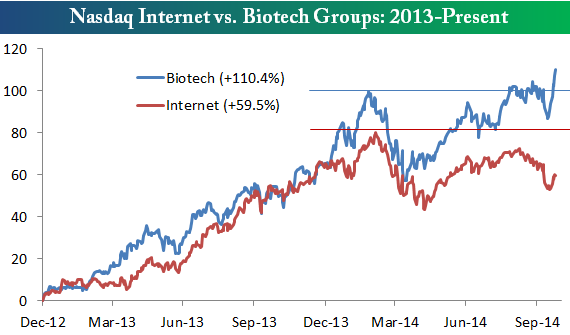

Chart of the day

Biotechs have been crushing Internet stocks of late. (Bespoke)

Markets

We are entering a historically positive time for the stock market. (Ryan Detrick)

When equity free cash flow yields are higher than junk bond yields, stocks tend to do well. (Michael Santoli)

Strategy

How brain science can tell just how big a (financial) risk taker you really are. (Jason Zweig)

David Merkel, “Nothing can prepare you for the event of loss except prior losses.” (Aleph Blog)

What a momentum investor looks for in a value fund. (Optimal Momentum)

Don’t buy stock in companies whose CEOs play a lot of golf. (Alpha Architect)

Companies

Some signs that Apple Pay is actually working. (Daring Fireball)

iTune music sales are in freefall. (WSJ)

How the iPhone ripples through the global economy. (NYTimes)

Finance

A (long) profile of Bill Ackman. (NYTimes)

A look at just how big a behemoth Charles Schwab ($SCHW) is. (Barron’s)

What would it take to change the culture of Wall Street? (HBR)

ETFs

Why the SEC was right to rule against nontransparent ETFs. (Invest with an Edge)

Global

Two measures that say British shares are cheap. (Telegraph)

What European banks failed the ECB stress test. (Guardian)

Economy

A look back at the economic week that was. (Big Picture)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

Podcast Friday looks at ballooning fees and managing your 401(k) plan. (Abnormal Returns)

What you might have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Tony Robbins is getting into the money game with a book Master the Money Game: 7 Simple Steps to Financial Freedom. (Meb Faber)

Three things you can do right now to improve your life. (TraderFeed)

The problem with positive thinking. (NYTimes)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.