Quote of the day

Jeff Miller, “As you watch or read the news next week, you should realize the pressure on pundits to be bold, dramatic, and confident – even when their forecasts are a bit shaky.” (A Dash of Insight)

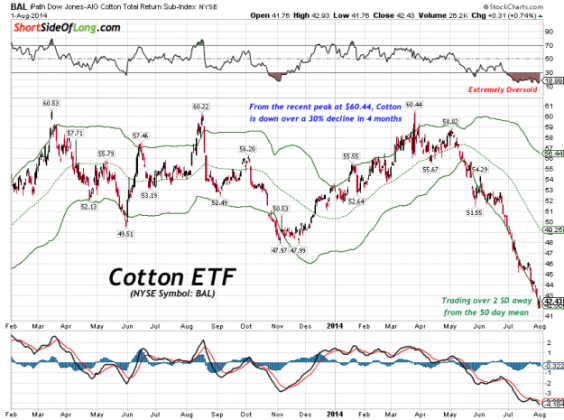

Chart of the day

Cotton prices have gotten crushed recently. (Short Side of Long)

Markets

What to expect after a sharp sell-off from 52-week highs. (Dana Lyons)

A look back at some meaningful corrections. (Chris Ciovacco)

Check out the spike in the equity call/put ratio. (Horan Capital)

A $VIX primer. (Adam Grimes)

Why you need to mentally prepare for inevitable market corrections. (A Wealth of Common Sense)

Strategy

Value investing can underperform for years at a time. (Alpha Architect)

Even great traders should expect to having losing streaks. (TraderFeed)

Form matters for investments but management even more. (Aelph Blog)

Companies

It’s time for Marissa Mayer to leave Yahoo ($YHOO). (TheStreet)

The power of Facebook ($FB) ad targeting. (NYTimes)

Is $9.99 the ideal price for e-books? (Bits)

Twitter’s ($TWTR) power users often don’t see ads. (WSJ)

Finance

Tax inversion deals are not tax-friendly for taxable investors. (WSJ)

The US tax code is a mess. (Musings on Markets)

An example of where “you get what you negotiate.” (The Epicurean Dealmaker)

Bad week or not the IPO market got some business done. (Quartz)

ETFs

Should we be worried about ETFs during times of market stress? (Barron’s)

Why the ETF creation/redemption process works. (ETF)

Bank loan ETFs have their share of critics. (Barron’s)

Mutual funds

The August mutual fund commentary is up. (Mutual Fund Observer)

A look at the Vanguard approach to actively managed funds. (Barron’s)

Global

The world’s stock markets are a mixed bag at the moment. (Short Side of Long)

The 16 most important global economic charts for the week. (Quartz)

What happens if Russian stocks get pulled from various indices? (WSJ)

An Argentina default Q&A. (Sober Look)

Economy

What did we learn about the economy this week? (FT Alphaville, Bonddad Blog, Big Picture)

The economic schedule for the coming week. (Calculated Risk)

None of the data this week should deter the Fed from their plans. (Tim Duy also Econbrowser)

The summer doldrums economically speaking a misnomer. (Bloomberg)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What books Abnormal Returns readers purchased in July 2014. (Abnormal Returns)

What you might have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Choices, even among good options, still can lead to anxiety. (New Yorker)

There are some material goods that can help make you happy. (The Atlantic)

Tony Schwartz, “(T)hreats to our value push us into defense mode, which is a zero sum game. Whatever energy we spend defending our value — staying safe — is energy not available to create value.” (Dealbook)

You can support Abnormal Returns by visiting Amazon. Don’t forget to follow us on StockTwits and Twitter.