Quote of the day

Richard Roeper, “Movie 43” is the “Citizen Kane” of awful.” (Roger Ebert)

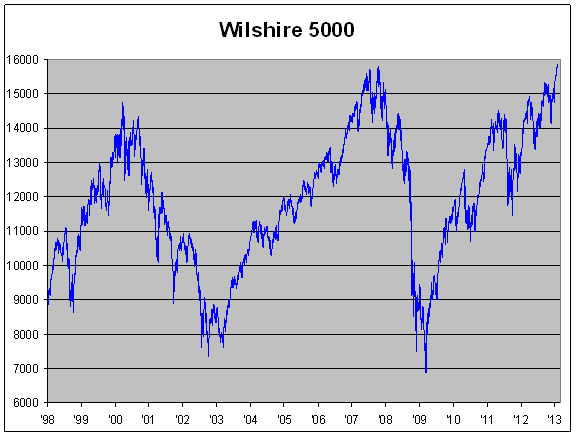

Chart of the day

The stock market is at a new all-time highs. (Crossing Wall Street)

Markets

Five years in, the bull market is finally front page news. (The Reformed Broker, Big Picture, Sober Look)

When the market finally puts aside the bad news, the risk is to the upside. (The Reformed Broker)

How do you get a secular bull market revved up? (Conor Sen)

What would surprise market participants the most at this point? (All Star Charts)

Overbought (Mexico) and oversold (Korea) markets. (Global Macro Monitor)

When profits are made in a serious trend. (Dynamic Hedge)

Strategy

Structured notes based on Apple shares took a bath this week. (Jason Zweig)

A little enlightenment could keep you from making some common investing errors. (Barry Ritholtz)

Beware companies trying to pass off earnings misses on the weather, politics, etc. (Kid Dynamite)

Revisiting the 4% withdrawal rule in retirement. (StreetEYE)

Apple

Time to start thinking about Apple ($AAPL) as a value stock. (Quartz)

Apparently investors have forgotten the past decade for Apple. (Pando Daily)

Peak Apple. (Economist)

Finance

Soros says hedge funds suck. (Bloomberg)

Ackman vs. Icahn: no one comes off well. (Dealbreaker, Kid Dynamite)

ETFs

Vanguard has some serious momentum. (InvestmentNews)

How much is Vanguard’s much publicized ETF index shifts costing investors? (Focus on Funds)

iShares is getting into the target date corporate bond ETF business. (IndexUniverse)

Global

UK austerity: a tale of the tape. (Econbrowser, Money Game)

Don’t get too excited about shrinking balances at the ECB. (WSJ, Sober Look)

A Q&A with Shaun Rein on The End of Cheap China: Economic and Cultural Trends That Will Change the World. (OpenMarkets)

Housing

Housing supplies keep tightening. (Quartz)

Rising home prices could bump up consumer spending. (WashingtonPost)

Robert J. Shiller, “The bottom line for potential home buyers or sellers is probably this: Don’t do anything dramatic or difficult.” (NYTimes)

Economy

A look back at the economic week that was. (Bonddad Blog, Calculated Risk)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

Don’t get fooled by preparing to fight the last investment war. (Abnormal Returns)

What you missed in our Saturday morning linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Health

Barack Obama, “I’m a big football fan, but I have to tell you if I had a son, I’d have to think long and hard before I let him play football. ” (TNR)

Want to burn fat? Work out on an empty stomach. (ScienceDaily)

Telemedicine is coming ever closer to reality. (GigaOM)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.