Holiday book alert! This weekend you can get an extra 30% off of any book at Amazon. If you have been waiting to buy Ben Horowitz’s The Hard Thing About Hard Things: Building a Business When There Are No Easy Answers or Peter Thiel’s Zero to One: Notes on Startups or How to Build the Future now is your chance!

Quote of the day

Seth Godin, “One reason people who spend a lot of time thinking about and working on a problem or a craft seem to find breakthroughs more often than everyone else is that they’ve failed more often than everyone else.” (Seth Godin)

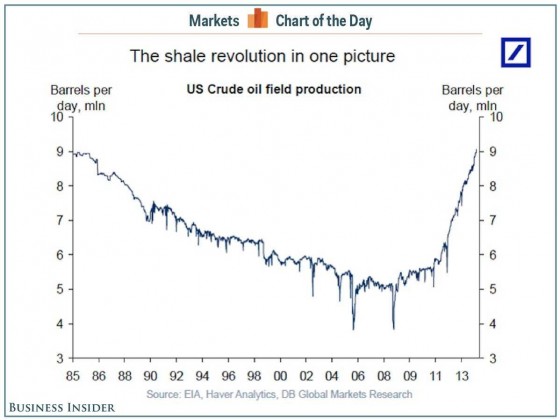

Chart of the day

Is this is the market chart of the year? (Business Insider)

Oil

Sentiment is getting pretty negative for oil. (Humble Student)

What opportunities have popped up due to the decline in oil prices? (A Dash of Insight)

A quick recap on why oil prices are falling. (Wonkblog)

Technology has a role in lower oil prices. (Nick Butler)

Gold

Gold is in a long-term downtrend. (Short Side of Long)

Gold miners continue to get crushed. (Focus on Funds)

High yield

Is it finally time for bank loan funds? (Barron’s)

The energy comedown is putting the hurt on the high yield market. (The Reformed Broker)

Oaktree Capital ($OAK) is struggling with a dearth of distressed opportunities. (Barron’s)

Strategy

Why have active managers done so poorly in 2014? (Jason Zweig)

On the benefits of outsourcing some decision making for your portfolio. (A Wealth of Common Sense earlier AR)

Other investors don’t necessarily have the same motivations as you. (Oddball Stocks via Monevator)

What separates a good company from a great company? (Clear Eyes Investing)

Companies

How ApplePay can become a billion dollar business. (Asymco)

Rethinking disruption theory using Apple ($AAPL) as an example. (Techpinions via Fortune)

Economy

A look back at the economic week that was. (Big Picture)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What you might have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Be careful when designing (and analyzing) business experiments. (HBR)

Is Internet addiction a real thing? (New Yorker)

You can support Abnormal Returns by visiting Amazon, signing up for our daily newsletter or following us on StockTwits, Yahoo Finance and Twitter.