Quote of the day

Andrew Beer, “Fee reduction is the purest form of alpha.” (All About Alpha)

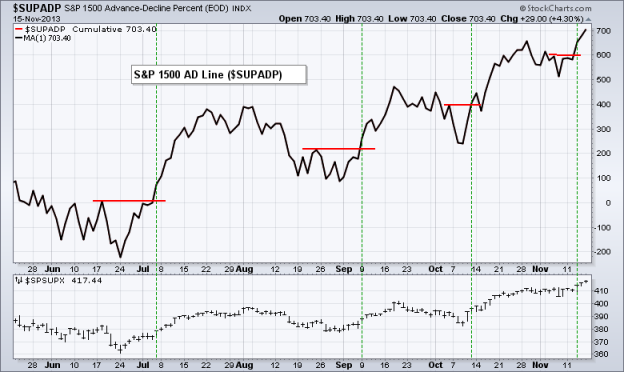

Chart of the day

Market breadth is confirming new market highs. (StockCharts Blog)

Markets

Bubble talk dominated the past week. (A Dash of Insight)

Five signs of a bubble: not there yet. (Mark Hulbert)

US stocks look expensive relative to the rest of the world. (WSJ, Barron’s)

Andy Kessler, “Once you’re allowed to invest in private startups, my advice is: don’t. Success is much harder than you might think.” (WSJ contra Points and Figures)

Financial media

How to get the most out of the financial media. (Barry Ritholtz)

What would a financial media roll-up look like? (Felix Salmon)

Technology

On the symbiotic relationship between Amazon ($AMZN) and Dropbox. (GigaOM)

Apple ($AAPL) made huge advances with this year’s new iPads. (Daring Fireball)

What’s Snapchat worth? Nobody knows. (The Reformed Broker, LATimes)

ETFs

The ten biggest ETF launches YTD. (IndexUniverse, Mebane Faber)

An ETF roundtable. (Barron’s)

There’s something you need to know about floating rate funds in a rising rate environment. (Jason Zweig)

Global

Is the Eurozone economy rolling over again? (Sober Look)

It’s hard to find inflation anywhere in the world. (NYTimes)

Economy

A discussion with the third Nobel prize winner Lars Peter Hansen. (NYTimes)

Banks are once again making auto loans. (Sober Look)

Why aren’t domestic gasoline prices even lower? (Econbrowser)

The rise in US farmland prices may finally be played out. (WSJ)

A look back at the week in economic statistics. (XE)

The economic schedule for the coming week. (Calculated Risk, Turnkey Analyst)

Earlier on Abnormal Returns

When actively managed funds make sense. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

To help your teens succeed get them to bed earlier. (The Atlantic)

Tim Geithner lands on his feet at Warburg Pincus. (Dealbook)

Software is the new hardware. (A VC)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.