Quote of the day

Jason Zweig, “Investing in stocks was never for the faint of heart; it just seemed that way for a while. In the massive exodus from stocks now under way, we may be witnessing the death rattle of the delusion that you can have financial gain without pain.” (WSJ)

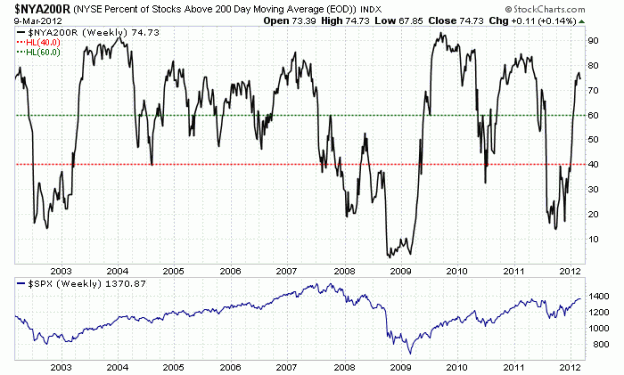

Chart of the day

How to interpret the percentage of stocks above their 200 day moving average. (Fireside Charts)

Markets

The wrong stocks are leading this rally of late. (Dynamic Hedge)

A look at stock market performance three years into the bull market. (Total Return, Big Picture)

Stocks vs. bonds: something has got to give. (Money Game)

The Treasury market has disengaged from everything, including investment grade credits. (Sober Look)

Buyout firms are getting bailed out by a bond market desperate for yield. (WSJ)

Strategy

If you are not trading your plan, what are you doing? (FaithMightFX)

Just how much do our genes affect our investing behavior? (Economist)

Companies

Why Apple ($AAPL) should return some cash to shareholders. (Economist)

Look who is the market for used iPad 2s. (Pando Daily)

Which monopoly do you prefer: Apple or Amazon ($AMZN)? (WashingtonPost)

Finance

Barron’s ranks the online brokers. (Barron’s)

Behind every high frequency trading algorithm there is a person. (socializing finance)

Banks are stepping up their efforts to woo the ‘mass affluent‘ crowd. (NYTimes)

ETFs

Whether you realize it or not you are likely in the securities lending business. (Barron’s)

Speculation about what Fidelity might do in the ETF space. (InvestmentNews)

Global

ISDA recognizes reality and declares a “credit event” in Greece. (WSJ, FT, Dealbook, MarketBeat)

CDS volumes will likely decline over time. (Felix Salmon)

A look at the PMI matrix. (Pragmatic Capitalism)

The Bank of Canada is contemplating an interest rate hike. (Globe and Mail)

Economy

Joe Weisenthal, “An improving labor market may not be great news for investors.” (Money Game)

Why the price of gasoline depend so very much on where you live. (NYTimes)

Why the Fed should stay on the side of easing. (Economist’s View, Modeled Behavior)

Why is there so much emphasis on manufacturing? (The Atlantic)

Low skill jobs are disappearing everywhere, including the office. (Sober Look)

Why college costs continue to rise. (NYTimes)

Earlier on Abnormal Returns

Why so many investors have missed out on the most hated bull market in history. (Abnormal Returns)

What you missed in our Saturday long form linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

The excitement around the world is growing for the launch of the Abnormal Returns book. (Quantitative Finance Club)

Mixed media

Why does the NCAA persist in using RPI that “has predicted the outcome of N.C.A.A. games more poorly than almost any other system”? (FiveThirtyEight)

There is regret, and there’s REGRET. (Dan Ariely)

Would a cashless society have less crime? (Slate)

Daylight savings time is still a scam. (Wonkblog)

Abnormal Returns is a founding member of the StockTwits Blog Network.