Quote Strip of the day

How exactly does the stock market work? (Real Life Adventures via Ritholtz)

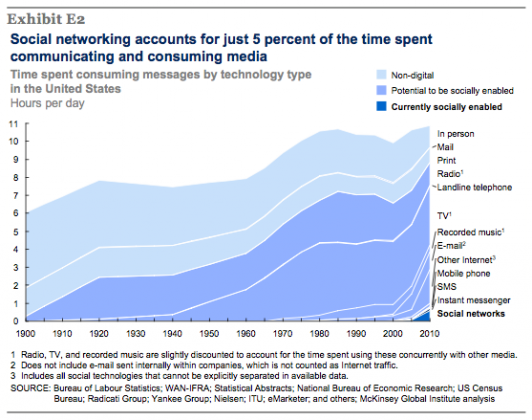

Chart of the day

How much of our time we do spend on social media? (McKinsey via The Atlantic)

Markets

The Sell in May trade is truing into a bit of wash. (The Reformed Broker)

How this earnings season has progressed. (Bespoke also Investing Caffeine, Money Game)

Why continued chop is still likely. (Humble Student of the Markets)

Strategy

When you want a company to miss earnings estimates. (Aleph Blog)

Is discretionary prop trading on the way out? (SMB Training)

Is there a “bubble” in dividend stocks? (Sizemore Insights)

Technology

Is the social media frenzy finally over? (WSJ, NYTimes)

In defense of Amazon’s ($AMZN) business model. (Kid Dynamite)

The factors behind the turnaround at eBay ($EBAY). (NYTimes)

Online ads stink as a business. (The Atlantic)

Apple

Apple’s retail stores are a key to their success. (YCharts Blog)

Why the next iPhone is so important to Apple ($AAPL). (Pando Daily)

Why Apple should invest in Twitter. (GigaOM)

Is the Mac App Store becoming irrelevant? (Marco Ament)

Finance

How deposit insurance makes the too-big-to-fail bank problem even bigger. (Jason Zweig)

Why doesn’t TheStreet.com ($TST) make money hand over fist? (World Beta)

One trader’s Libor story. (Planet Money)

ETFs

Short-term junk bond funds are becoming increasingly popular. (WSJ)

Can Pimco survive the transition away from Bill Gross? (NYTimes)

Hedge fund managers can’t keep their hands off of the mutual fund business. (Barron’s)

Global

The great currency war of 2007-2012 is over. (The Atlantic)

Corporate cash hoarding is a global phenomenon. (Wonkblog)

Economy

The US manufacturing sector now has some serious headwinds. (Sober Look)

Weak restaurant results this week point to a cautious consumer. (Real Time Economics)

Why future tax law changes should bolster philanthropy and not cut back on it. (NYTimes)

Earlier on Abnormal Returns

What you missed in our Saturday long form linkfest. (Abnormal Returns)

What every one was was reading on Abnormal Returns this week. (Abnormal Returns)

Mixed media

Why we should focus on Mars this summer and not the Olympics. (HuffingtonPost)

What constitutes a ‘fast pool‘? (LiveScience)

Abnormal Returns is a founding member of the StockTwits Blog Network.