Quote of the day

David Merkel, “A vehicle holding assets [i.e. ETP] may appear more liquid than the assets themselves, but that is only true in bull markets. When bad times come, the liquidity proves elusive, particularly for large trades.” (Aleph Blog)

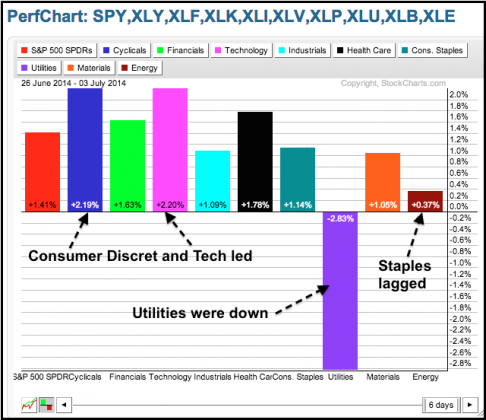

Chart of the day

Sign of the times? Utilities had a rough week. (StockCharts Blog)

Markets

Once again with feeling: the stock market is not the economy. (Business Insider)

Why good news is still good news for the market. (A Dash of Insight)

Checking in on some popular market valuation measures. (Above the Market)

Four surprises markets faced in the first half of 2014. (Investing Caffeine)

Have metals bottomed? (The Short Side of Long)

Strategy

Why investors should be wary of having too much in their own company’s stock. (Jason Zweig)

When to be a contrarian. (Dragonfly Capital)

The best websites for quants. (Barron’s)

Trading

Does your trading reflect your own “signature strengths“? (TraderFeed)

Investors and traders have very different timeframes. (Gatis Roze)

On the parallels between trading and startups. (Points and Figures)

Finance

Why more investors are likely to flee dark pools. (NYTimes)

Fidelity is getting tougher on executive compensation schemes. (FT)

Where did all the volume go? (MoneyBeat)

ETFs

Target-date mutual funds are taking over the world. (Barron’s)

How to build a portfolio using only index funds. (Jonathan Clements)

Autos

The world can’t get enough German luxury cars. (Quartz)

Why American cars are getting more fuel efficient. (Vox)

Self-driving semis are on the horizon. (NYTimes)

Economy

Reviewing 10 big economic questions for 2014. (Calculated Risk)

Rail traffic is growing like crazy. (Business Insider)

Jobs growth now seems more self-sustaining. (Econbrowser, Wonkblog)

What now for the FOMC hawks? (Tim Duy)

A look back at the economic week that was. (Bonddad Blog, Big Picture)

The economic schedule for the coming week. (Calculated Risk)

An interview with Mark Thoma about economics and blogging. (Incomics Blog)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What you might have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

The summer’s most un-read book is…. (WSJ)

How to teach your kids how to tie their own shoes. (EconLog)

On the benefits of spending time alone. (TraderFeed)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.