Quote of the day

DH, “Sentiment is no longer low, but hate is still near record highs. All the while, the market continues to act very well.” (Dynamic Hedge)

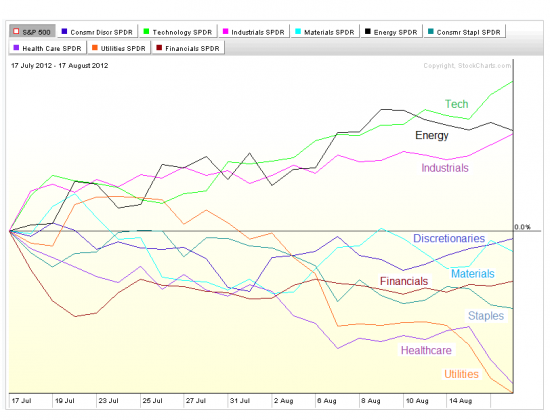

Chart of the day

Check out the sector rotation going on during this rally. (All Star Charts)

Markets

A secular low in 30-year yields would set off a “great rotation.” (Money Game)

Just because the $VIX is low doesn’t mean it can’t go lower. (MarketBeat)

Muni bond investors are quacking. (WSJ)

Death of equities

Why are “real money” equity volumes so low? (FT Alphaville)

Where has the retail investor gone? (Barry Ritholtz)

Strategy

Take the investment advice you hear from the media with a big grain of salt. (Aleph Blog)

Some hedge funds are dipping their toes into the coal sector. (Pension Pulse)

Barron’s puts the spotlight on MLPs. (Barron’s)

Technology

Why are so many investors skeptical about Intel ($INTC)? (YCharts Blog)

Building stuff, like consumer electronics, is the new web startup. (WSJ)

Pinterest is growing its own ecosystem at present. (VC Dispatch)

Why payment fees are headed toward zero. (TechCrunch)

Finance

How the hedge fund industry is like the restaurant industry. (Dealbook)

Which field required more luck to succeed: the arts or finance? (Felix Salmon, The Reformed Broker)

Morgan Stanley ($MS) has distributed Facebook ($FB) IPO “profits.” (WSJ, SAI)

A paper that looks at those banks that were “too central to fail.” (Marginal Revolution)

Global

A majority of national home prices are cooling off. (Economist)

Who gained the most from the Euro? (Marginal Revolution)

Slovenia is likely going to have to get bailed out as well. (Economist)

Economy

Does a bullish stock market forecast faster economic growth? (FiveThirtyEight)

US growth may be slow but it still trumps Europe. (NYTimes)

Did the Fed make a mistake in targeting 2% inflation? (Tim Duy)

The economic recovery has been consistent in its tepidness. (macroblog)

How that whole deleveraging thing going? (Pragmatic Capitalism)

Earlier on Abnormal Returns

Facebook schadenfreude is wasted emotion. (Abnormal Returns)

What you missed in our Saturday long form linkfest. (Abnormal Returns)

What everyone else was clicking on this week on the site. (Abnormal Returns)

Mixed media

Remove the word “impossible” from your vocabulary if you ever want to succeed. (Kirk Report)

Why do so many people today have OSD or obsessive sharing disorder? (NYTimes)

Abnormal Returns is a founding member of the StockTwits Blog Network.