Quote of the day

Phil Pearlman, Indexing is “the worst form of retirement investing except for all the others.” (Yahoo Finance)

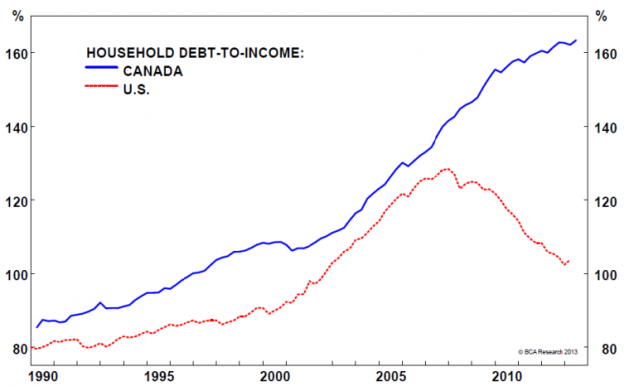

Chart of the day

Does Canada have a debt problem? (Time)

Markets

Joshua Brown, “The lesson that this kind of thing has taught me over the years is that to hate an asset class or a sector is irrational – we should only hate the prices. Because almost everything can be either a good buy at some point.” (The Reformed Broker)

Everybody hates bonds. (Barry Ritholtz)

Wall Street hates commodities. (The Short Side of Long)

Why do market valuation debates invoke so much emotion? (A Dash of Insight)

Consumer anything had a bad week. (Dynamic Hedge)

Gold

Keep and eye on gold’s short-term downtrend line. (chessNwine, MoneyBeat)

Have gold miners finally made a durable bottom? (Market Anthropology)

What do the flow in and out of gold ETFs tell us? (Minyanville)

Strategy

Morgan Housel, “I’ve become almost fatalistic on this, and think most people can improve their financial lives by distancing themselves from as many forecasts as possible.” (Motley Fool)

Dividend investors need to start thinking outside the box for new ideas. (Clear Eyes Investing)

You can only become a better investor by actually investing. (Oddball Stocks via Monevator)

Four financial rules that need to be reassessed. (Chuck Jaffe)

Companies

Why would any one want to be CEO of Martha Stewart Living ($MSO)? (Businessweek)

The “reach” of Facebook ($FB) has declined dramatically for businesses promoting themselves. (Business Insider)

Amazon ($AMZN) wants to ship you a package before you actually order it. (Digits)

Why we need “dumb pipes and smart apps.” (Howard Lindzon)

Why does Dropbox need all that cash? The competition. (TechCrunch, Quartz)

On the downside of the startup life. (Economist)

Finance

So far, so good for Buffett’s two money manager hires. (WSJ)

Hedge funds are once again big players in the startup space. (TechCrunch)

Why isn’t the CME ($CME) doing better? (Crain’s Chicago via @pointsandfigures)

Funds

Trying to pick an active manager? Make sure fees are low and active share is high. (WSJ)

In praise of tax-efficient fund management. (Turnkey Analyst)

Economy

Is the Fed misreading the labor market? (Business Insider)

Why QE hasn’t really helped credit growth. (Sober Look)

Should the Fed try and tame bubbles? (Real Time Economics)

A look back at the economic week that was. (Bonddad Blog, Big Picture)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

Indexing is no panacea for investors. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

What you missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Why re-mixes don’t often exceed the original. (Tim Harford)

Why our gut instincts often lead us astray. (Guardian)

Why you should swap resolutions for rituals. (Tony Schwartz)

You can support Abnormal Returns by visiting Amazon. You can also follow us on StockTwits and Twitter.