Quote of the day

John Hempton, “Long term care insurance is the worst business I have ever seen.” (Bronte Capital)

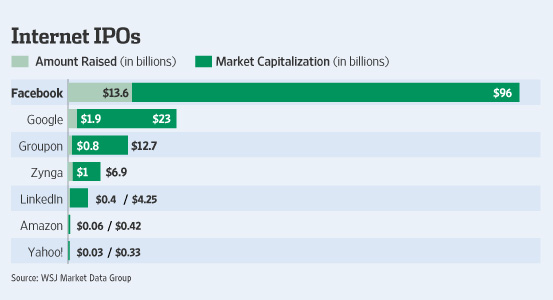

Chart of the day

How Facebook’s IPO stacks up. (Deal Journal)

Markets

A lot of sectors are sitting right at their trendlines. (UpsideTrader)

How should we interpret the market cap/GDP ratio? (Big Picture)

One reason why equity volumes are dropping. (The Reformed Broker)

A look at gold miner sentiment. (Financial Freepress)

Rydex traders are still really bullish. (The Technical Take)

Strategy

Active fund manager types to avoid. (Barry Ritholtz)

In search of a simple, more intuitive market risk measure. (Above the Market)

Where David Rosenberg thinks you should put your money. (StreetTalk Live)

Companies

Two stub plays via Hunter at Distressed Debt Investing. (The Brooklyn Investor, ValueUncovered)

Does anyone, including Jeff Bezos, understand what Amazon ($AMZN) is up to these days? (Pando Daily)

Why is Yahoo! ($YHOO) in such a rush to do an Alibaba deal? (Eric Jackson)

Berkshire Hathaway

Five things learned at the Berkshire Hathaway annual meeting. (Term Sheet)

Some are betting on Ajit Jain to be the next CEO of Berkshire Hathaway ($BRKA). (WSJ)

This analyst thinks you can do better than investing in Berkshire. (Term Sheet)

More takes on Berkshire’s insurance businesses. (Deal Journal)

Finance

Should robots replace regulators when it comes to inspecting investment advisers? (Jason Zweig)

Is the CME Group ($CME) really the most powerful company in the world? (Points and Figures)

Could options market makers now get paid? (Focus on Funds)

ETFs

Investors eat dollar weighted returns. (Aleph Blog)

Exotic ETFs may soon be out of the reach of unsophisticated investors. (InvestmentNews)

Want to invest in Saudi Arabia? There is an ETF for that. (IndexUniverse)

Global

The opportunity in frontier markets. (Enterprising Investor)

Great…now we have to worry about India’s economy. (Tyler Cowen)

Japan is doing everything it can to weaken the Yen. (Economist)

Economy

Another housing bear is switching sides. (Calculated Risk)

A one graph summary of the US housing market. (Calculated Risk)

Monetary policy matters less every day. (Marginal Revolution)

American manufacturing workers are working some long hours. (Slate)

Why “stimulus now, austerity later” won’t work in practice. (The Atlantic)

Earlier on Abnormal Returns

Five good questions with Tadas Viskanta. (Abnormal Returns)

Top clicks this week on Abnormal Returns. (Abnormal Returns)

What you missed in our Saturday long form linkfest. (Abnormal Returns)

Mixed media

We are often unable to separate the message from the messenger. (Justin Fox)

Why the first twenty minutes of exercise are so important. (Well)

Reduce stress by taking e-mail vacations. (Bits)

Abnormal Returns is a founding member of the StockTwits Blog Network.