Quote of the day

Jonathan Eley, “If momentum investing is so simple, why don’t more people do it? One reason might be that its crudeness offends our intellectual sensibilities.” (FT)

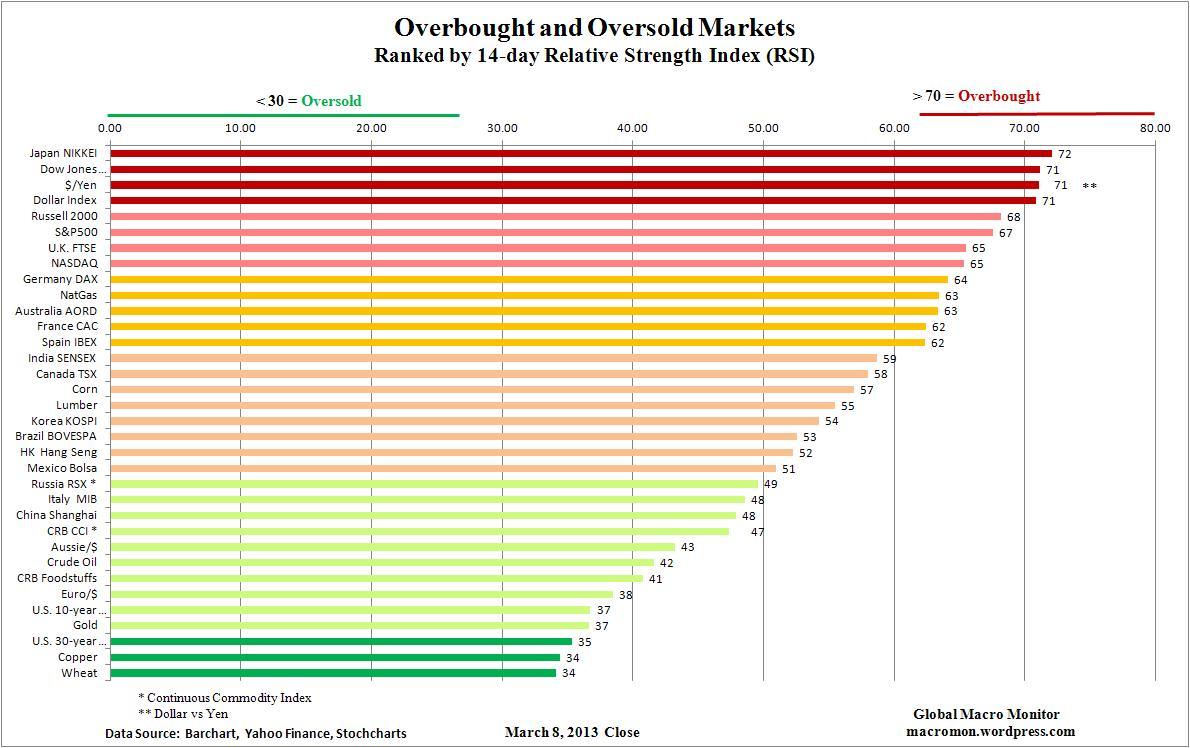

Chart of the day

Japanese equities are overbought, while wheat not so much. (Global Macro Monitor)

Markets

Happy fourth anniversary, the “Impossible Rally“! (The Reformed Broker)

Why aren’t individual investors more bullish? (Phil Pearlman)

Breadth is still holding up. (Dynamic Hedge)

P/E ratios are creeping higher. (Bespoke)

Emerging market bonds look like safe havens for now. (Jason Zweig)

Strategy

Why most people hate good financial news. (Pragmatic Capitalism)

Some thoughts on risk and being wrong. (All Star Charts)

Keep an open mind and recognize that general advice is general for a reason. (A Dash of Insight)

Behavioral finance 101: the case of the trading barber. (The Reformed Broker)

The misunderstanding around the so-called “conviction trade.” (SMB Training)

Why is there so little correlation between economic growth and the stock market? (Buttonwood)

On the inscrutable nature of investor confidence. (NYTimes)

Companies

On the prospect for further Web 2.0 consolidation. (Pando Daily)

Apple’s ($AAPL) real problem is if it starts losing good people. (SAI)

Why Apple needs to make a ‘halo computer.’ (Hypercritical)

Finance

How much of the market rally can we attribute to share buybacks? (Dealbreaker also Focus on Funds)

Activist investors serve a useful role in checking management. (Musings on Markets)

The Norwegian SWF is swapping out Europe for emerging markets. (The Source)

A review of the best online brokers. (Barron’s)

ETFs

On the prospects for a distressed debt ETF. (Deal Journal)

On the differences between bank loan funds and high yield bond funds. (Learn Bonds)

Not all low vol ETFs are created alike. (IndexUniverse)

Short interest is growing in the high yield bond funds. (FT also FT Alphaville)

On the return (and risk) of securities lending. (IndexUniverse)

Japan

Japan’s stock market has been down so long any decent rally will still pale in comparison. (Quartz)

Other ways to play Japan besides the WisdomTree Japan Hedge Equity ETF ($DXJ). (IndexUnvierse)

Economy

Looks at the generally positive employment report. (Calculated Risk, Quartz, Tim Duy, Daniel Gross, The Atlantic, Felix Salmon)

Is wage growth finally materializing? (Money Game)

Move along there is nothing to see in this high profile recession call. (Modeled Behavior also Econbrowser)

Still not much in the way of financial stress. (Carpe Diem)

A look back at the economic week that was. (Bonddad Blog, Calculated Risk)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

The best tweets for your money. (WSJ.Money)

What you missed in our Saturday morning linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Mixed media

What to do when someone gives you a shot. (Howard Lindzon)

Just how much credit is needed when credit is due. (paidContent)

LED bulb prices are reaching a tipping point. (Scientific American)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.