Quote of the day

Brett Steenbarger, “Elite performers–in music, theater, professional sports, chess–spend more time practicing and preparing than actually performing in competition.” (TraderFeed)

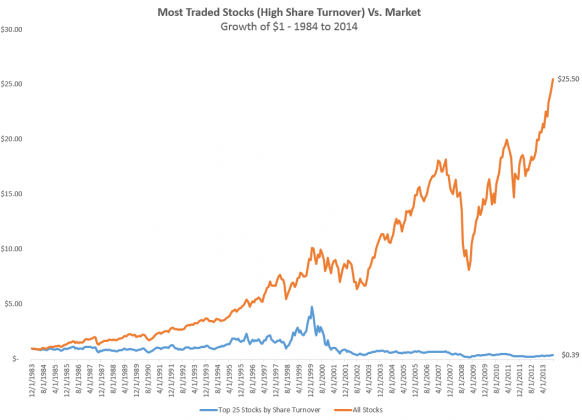

Chart of the day

Why you should avoid the most popular stocks. (Millenial Invest)

Markets

If the market tanks, is it that big a deal to the economy? (The Reformed Broker)

Why the bull market (and economy) still have a couple of years to run. (Conor Sen)

Can positive economic trends overcome the weight of market seasonality? (A Dash of Insight)

More quotes

Mike Piper, “Uniqueness is overrated when it comes to investing.” (Oblivious Investor)

Derek Hernquist, “We may differ on whether value or momentum are the best paths to get there, but without the opportunity to make more on our winners than we lose on our losers, we have no shot at sustainable success.” (Derek Hernquist)

Joshua Brown, “Just because something is available and possible, doesn’t mean a firm that cares about its customer base needs to grant them access to it (or encourage it).” (The Reformed Broker)

David Merkel, “If there are no good deals, profitable investing sits on cash, and waits for a better day.” (Aleph Blog)

Companies

Is it time to break up Berkshire Hathaway ($BRKB)? (Economist)

Apple ($AAPL) is now THE iPhone company. (Business Insider)

Maybe we shouldn’t be lumping smartphones in along with tablets after all. (Benedict Evans also A VC)

Finance

The head of Vanguard is pro-HFT. (FT)

Will crowdfunding turn private markets into public markets? (Ivanhoff Capital)

Funds

Many investors never did participate in the post-financial crisis rally. (Chuck Jaffe)

Why managing a “bloated” fund is so difficult. (research puzzle pix)

Economy

The US job market is “firming up.” (Sober Look)

How worried should we be about the housing recovery? (Business Insider contra Bonddad Blog)

Why the Fed will miss Jeremy Stein. (Gavyn Davies)

A look back at the economic week that was. (Bonddad Blog, Big Picture)

The economic schedule for the coming week. (Calculated Risk, Turnkey Analyst)

Earlier on Abnormal Returns

Reveling in the messiness (of investing). (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Why modernity is better than it seems. (Noahpinion)

What is a “complex adaptive system“? (Farnam Street)

The complete guide to structuring your day. (Quartz)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.