Quote of the day

Agnes T. Crane, “No one starting afresh would design today’s municipal bond market.” (Reuters)

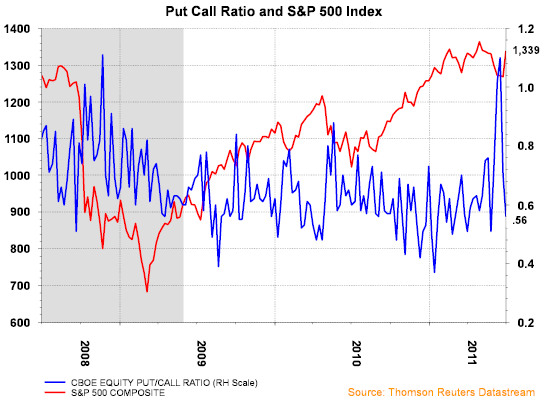

Chart of the day

The CBOE equity put-call ratio did a good job of calling this market turn. (Horan Capital also StockCharts Blog)

Markets

A sneak preview of Q2 earnings. (Money Game)

Positive earnings surprises are the norm, not the exception. (WSJ)

$150 oil, not so fast. (Big Picture)

The shorts really hate these five stocks. (MarketBeat)

Strategy

Jeff Miller, “People hate to buy back a stock at a higher price, and they hate to chase. ” (A Dash of Insight)

On the value of a first half review of your trading. (Attitrade)

Trading may be a crapshoot, but your broker always get paid. (MarketShot)

Companies

Sysco ($SYY) not Cisco ($CSCO). (YCharts)

Why a Google ($GOOG)-Hulu deal may make sense. (TechCrunch)

Rooting for Google+. (A VC)

GoDaddy goes private in a deal with KKR/Silver Lake. (Bloomberg, Dealbook)

Zynga IPO

Why is Zynga in a rush to go public? (TechCrunch)

What is Zynga worth? (The Tech Trade)

Can Zynga diversify its very profitable business away from Facebook? (WSJ, ibid)

For a company of its size, Zynga has not done all that many acquisitions. (GigaOM)

Finance

Did the average CEO do 23% better work last year? (The Refrormed Broker)

Companies are running away from the business of managing money market mutual funds. (WSJ)

Why did Madoff’s scheme last so long? (Aleph Blog, ibid)

Global

The Brazilian real is at a twelve year high against the dollar. (FT, Marginal Revolution)

What emerging economies are on the verge of overheating? (Free exchange)

A thought experiment: is Greece better off for having entered the Euro? (Interfluidity)

Economy

What QE2 accomplished. (Econbrowser)

The ISM manufacturing survey hints at faster GDP and employment growth. (macrofugue also Curious Capitalist)

The World Bank is opening up its “treasure chest of data” to outsiders. (NYTimes)

There are a lot of open economics-related positions in the administration. (Economist’s View)

Earlier on Abnormal Returns

Top clicks this week on Abnormal Returns. (Abnormal Returns)

What you missed in our Saturday longform linkfest. (Abnormal Returns)

Mixed media

Michael Martin talks with Howard Lindzon. (MartinKronicle)

The world is an Internet startup these days. (John Battelle)

A review of The Filter Bubble: What the Internet is Hiding From You by Eli Pariser. (Economist)

Nathan Myhrvold has some July 4th grilling tips. (big think)

Abnormal Returns is a founding member of the StockTwits Blog Network.