Quote of the day

Ivanhoff, “The outcome of your investment depends on the price you pay for it and on the price other people will be willing to pay for it in the future. There are no guarantees that if one company keeps growing its sales and earnings, its price will continue to appreciate.” (Ivanhoff Capital)

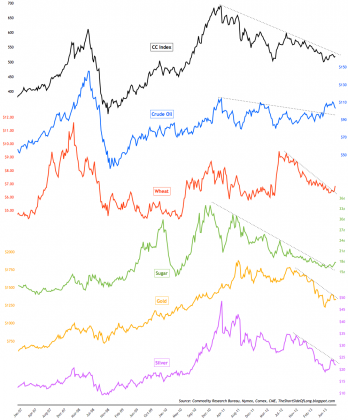

Chart of the day

The mixed picture that is commodities. (The Short Side of Long)

Markets

Seasonal patterns are not perfect. (Pragmatic Capitalism, Points and Figures)

Invest in what Wall Street hates. (Brett Arends)

Why is Alibaba listing in the US? (The Atlantic)

Strategy

How to avoid the next bubble. (Jason Zweig)

John Rekenthaler, “Risk is the danger that anything unpleasant might occur to a portfolio.” (Morningstar)

Most investors should just let the crowdfunding wave pass by. (HBR)

Just because you think the stock market is going lower does not mean you should sell stocks. (Henry Blodget)

Another nice review of John Mihaljevic’s The Manual of Ideas: The Proven Framework for Finding the Best Value Investments. (Rational Walk)

Companies

The most impressive thing about iOS 7.0 is that it doesn’t suck. (Business Insider also HBR, The Verge)

The four thing big companies need to reinvent themselves: the case of Microsoft ($MSFT), Cisco ($CSCO) and Merck ($MRK). (Musings on Markets)

Why Ford ($F) CEO Alan Mulally should run Microsoft. (Business Insider)

Do e-cigarettes pose a mortal threat to the cigarette industry? (Economist)

Startups

Will AngelList syndicates replace angel investor groups? (Points and Figures)

Are VCs now at-risk to these power angels? (Jason Calcanis)

Can an angel investor how have access to too much capital? (Hunter Walk)

Being a lead investor is not easy? (A VC)

Who should invest in startups? (Priceonomics Blog)

Economy

Why a government shutdown is likely. (A Dash of Insight)

Doing a little Kreminology at the Fed. (Tim Duy)

How QE is affecting credit markets. (Pragmatic Capitalism, ibid)

A look back at the economic week that was. (Bonddad Blog)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

One reason why you should quit flying: global warming. (Business Insider)

Why the paid-upfront app is dead. (Marco Ament)

The genius of Twitter. (TechCrunch)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.