Quote of the day

Barry Ritholtz, “Investment banks find they have become outgunned by dynamic, self-forming expert networks on Twitter. All transparent, in public, in real time.” (Washington Post)

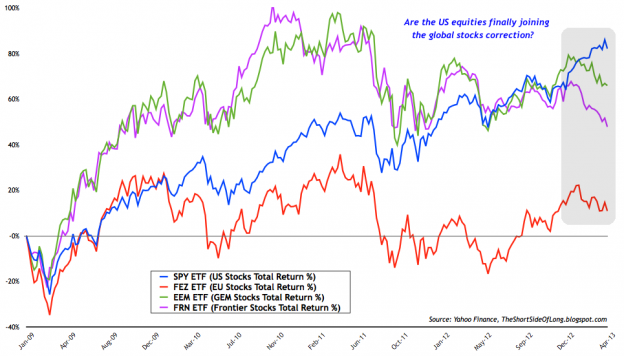

Chart of the day

Are US equities ready to join the global correction? (The Short SId eof Long)

Markets

Time to get defensive. (Dynamic Hedge)

What Value Line says about equity returns four years out. (Mark Hulbert)

The US is doing a lot better than many emerging markets. (Jason Zweig)

The Dow has been consolidating for over a decade now. (TheArmoTrader)

Commodities

Copper has joined gold on the downside. (StockCharts Blog, ibid)

Natural gas is now overbought while gold and copper are decidedly not. (Global Macro Monitor)

Why have commodities decided to go down now? (NYTimes)

Comparing gold-related ETP returns. (IndexUniverse)

Strategy

When regulators give investors asset allocation advice. (self-evident)

The fundamentals of market tops. (Aleph Blog)

Thoughts on gold as an investment. (Musings on Markets)

Why stock market investors are so often disappointed. (Your Wealth Effect)

Companies

Apple’s ($AAPL) stock has simply gotten too cheap, unless you think people are going to stop buying smartphones. (SAI)

Analysts keep cutting Apple earnings estimates. (Apple 2.0)

How is AOL ($AOL) doing reinventing itself as as media company? (Economist)

Why you should attend the Fairfax Annual Meeting. (BeyondProxy)

Finance

On the prospect for “freer and fairer” trading on the NYSE, post-merger. (WSJ)

Before there were housing bubbles, there were land bubbles. (NYTimes)

Economy

Stimulus without reform is a sure loser. (Tim Duy)

A look back at the economic week that was. (Bonddad Blog, Calculated Risk)

The economic schedule for the coming week. (Calculated Risk)

The deficit is shrinking pretty quickly. (Calculated Risk)

Earlier on Abnormal Returns

What you missed in our Saturday morning linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Mixed media

Great advice for a start-up founder. (Information Arbitrage)

Why Twitter Music is going to work. (Wired)

Breaking news is broken. (Slate)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.