Quote of the day

Roger Ehrenberg, “In short, know thyself and stay true to the mission.” (Information Arbitrage)

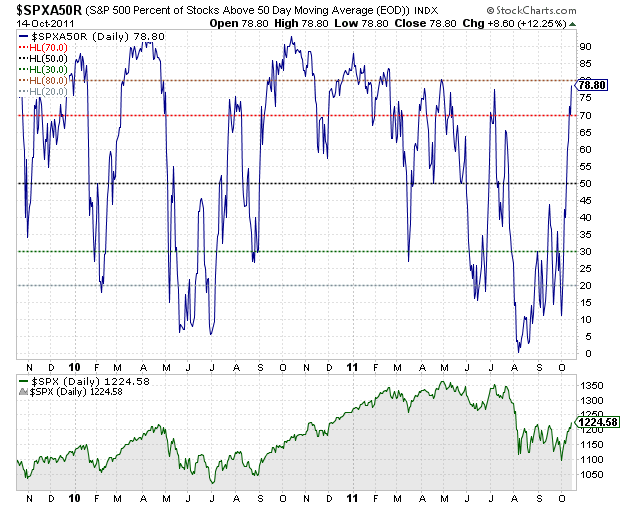

Chart of the day

A rapid turnaround: the percentage of S&P 500 stocks above their 50 day moving average. (Fireside Charts)

Video of the day

Rob Arnott of Research Affiliates talks with Consuelo Mack. (Wealthtrack)

Markets

Another look at higher breadth readings. (Bespoke)

Now is the time to start dip back into the housing market. (WSJ)

The PrimeX indices have gone prime time. (FT Alphaville)

Farmland

Pensions funds are pouring into the farmland market. (FT)

The Feds are worried about the rapid rise in farmland prices. (Businessweek)

Agriculture are not a ‘no-brainer’ investment. (WashingtonPost)

Commodities

The case for giving up on commodities. (WSJ)

Oil has disengaged from the rest of the commodity crowd. (Globe and Mail)

Does speculation drive oil prices? (FRB Dallas)

Strategy

Why investors find it so difficult to “harvest their losses.” (WSJ)

How to drown out the market’s increasing noise. (Derek Hernquist)

Most investors have no idea what alternative assets are. (InvestmentNews)

Why selling calls ‘into a rip’ can make sense. (Phil Pearlman, Tyler’s Trading)

Past performance is no guarantee: the case of John Paulson. (NYTimes)

An oldie but a goodie, a look at stock loss orders. (Big Picture)

Companies

Apple ($AAPL) as slingshot. (Apple 2.0)

How much do Apple’s factories cost? (Asymco)

Barron’s once again makes the case for the financials, including Morgan Stanley ($MS). (Barron’s, ibid)

Finance

A better way to buy back shares. (Dealbreaker)

The many issues surrounding mortgage REITs. (WSJ)

Ameriprise Financial has some explaining to do. (NYTimes)

Don’t expect credit card charge-offs to get much better. (Real Time Economics)

ETFs

A look at the performance of leveraged ETFs. (CXO Advisory Group)

Is the bloom off the WisdomTree Investments ($WETF) rose? (Barron’s)

Global

Why do French bond yields continue to blow out relative to German yields? (Global Macro Monitor)

Looking for value in European corporate (non-financial) bonds. (WSJ)

Do Canada’s banks deserve their rich premium? (HistorySquared)

It seems like everyone is cooking the books these days. (The Psy-Fi Blog)

Economy

Economic numbers keep coming in better than expected. Is Operation Twist why? (Money Game)

Is recent consumer spending supported by the facts? (macrofugue)

Bill Gross is looking for 0% growth in the developed economies. (Money Game, Dealbreaker, FT, Fundmastery Blog)

Is economic volatility the new normal? (Calculated Risk)

The economy is still “grinding it out” but everyone still thinks we are in a recession. (Daniel Gross)

What the Occupy Wall Street crowd should be calling for. (Big Picture)

Earlier on Abnormal Returns

What you missed in our Saturday morning linkfest. (Abnormal Returns)

The most crowded trade in the world. (Abnormal Returns)

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Mixed media

Why are biases so hard to overcome. (WSJ)

Are video gamers better technical analysts? (Phil Pearlman)

The best MBA programs and is time running out on non-elite programs? (Economist, ibid)

Abnormal Returns is a founding member of the StockTwits Blog Network.