Quote of the day

Jason Zweig, “The faster Wall Street runs, the more you should slow down and step back from that madness.” (MoneyBeat)

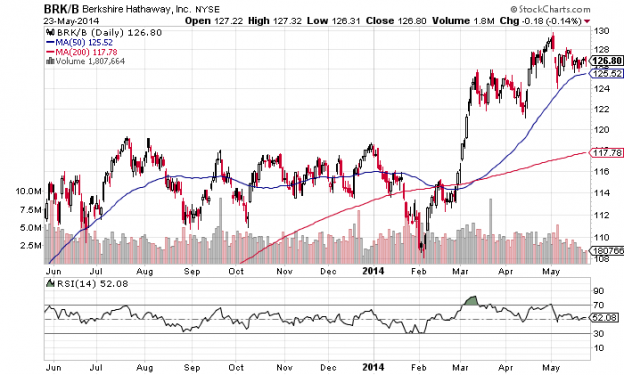

Chart of the day

Some hints as to who will some day run Berkshire Hathaway ($BRKB). (Jeff Matthews)

Markets

Market sentiment is on a hair trigger. (Joe Fahmy)

Why the metals, like silver, could play catch up. (The Short Side of Long)

Strategy

Just because a strategy is “sophisticated” doesn’t mean it works. (Dynamic Hedge)

Most businesses can’t scale. (Oddball Stocks via @monevator)

Low vol stocks decline less in a correction even if they are more expensive than usual. (Alliance Bernstein)

How to be valuable in the investment business. (Aleph Blog)

Companies

Amazon ($AMZN) is in a knock-down, drag out fight with some publishers. (Bits also Digitopology)

Hewlett-Packard ($HPQ) is increasingly a printing company. (Quartz)

Why Apple ($AAPL) should make iCloud storage free. (TechCrunch)

Hedge funds

Should hedge funds be expected to beat the S&P 500? (Mark Hulbert)

Hedge funds contribute to equity pricing efficiency, except during crises. (Federal Reserve)

Global

Did Thomas Piketty, author of Capital in the Twenty-First Century, get his math wrong? (FT, ibid, Money Supply)

And the responses. (The Upshot, Marginal Revolution, Free exchange, Quartz)

Should we be worried that the world’s economy is again pretty placid? (Economist)

Economy

Why reporting on housing is misleading. (A Dash of Insight)

The ten most important economic charts from a pretty good week. (Quartz also Big Picture)

The economic schedule for the coming week. (Calculated Risk, Alpha Architect, WSJ)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Why you can’t rely on Google ($GOOG) if you are an online publisher. (Daring Fireball)

Retailmenot ($SALE) got crushed by Google’s algorithm changes. (Priceonomics Blog)

Ten algorithms that rule our world. (io9)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.