Quote of the day

MG Siegler, “Apple’s iPhone business alone is larger than all of Microsoft’s businesses combined.” (parislemon via SplatF)

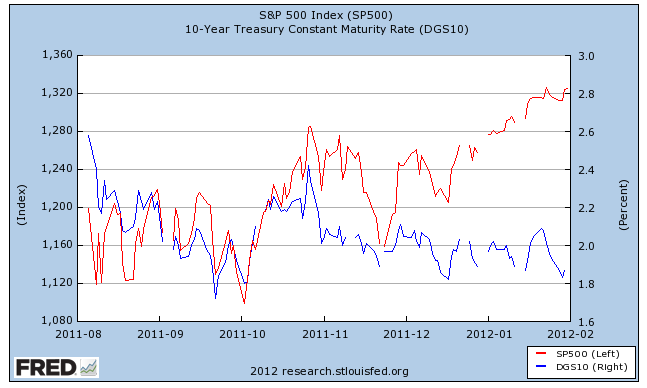

Chart of the day

Remember that whole S&P downgrade of the USA? (Money Game)

Markets

Hard to see much wrong with the market advance, besides the jump in “junk stocks.” (Dynamic Hedge)

On the lookout for a correction. (Derek Hernquist)

How the rise of ETFs have affected small cap stocks. (MarketBeat)

Strategy

Confusing politics and economics is a money loser. (The Reformed Broker)

Technical analysis is done in two very different ways. (Condor Options)

Why you should still be holding some cash to take advantage of temporary dislocations. (Pragmatic Capitalism)

Charles Kirk, “The challenge, as all of us will learn soon or later learn, is that Mr. Market doesn’t listen or care about anyone’s else opinion but his very own.” (Kirk Report)

Chess, “Mr. Market has a great knack for turning even the most polished of veteran chartists into incorrect fools.” (chessNwine)

Facebook ($FB) and the St. Petersburg Paradox: valuation matters. (Jason Zweig also Big Picture)

IPO reason #1: Zuck is going to have to write the Feds a BIG fat check. (FT, NYTimes)

The Facebook-Zuck options situation is going to raise some eyebrows, tax-wise. (Musings on Markets)

The investment proposition that is handing your money over to Zuck. (Slate)

The Facebook IPO is going to get new investors interested in equities. (MarketPsych)

The ‘Eggs in One Basket’ Index: how dependent are the big tech firms on various revenue sources. (SplatF)

Thanks to Facebook Silicon Valley engineers are finally getting their due. (Pando Daily)

Finance

“The IT revolution cannot be unwound; finance is now an IT industry. But it MUST be seen as a special case…” (MacroBusiness)

The global financial system can’t really go back the good old days. (The Epicurean Dealmaker)

The suspect economics of publicly traded, private equity managers. (Clusterstock)

Where are we in the IPO cycle? (NYTimes)

Private, secondary markets can only take you so far. (Dealbreaker)

Will weather derivatives ever be anything more than a nice product for farmers? (Economist)

Funds

Is the crackdown on insider trading to blame for recent poor hedge fund performance? (Forbes)

Don’t believe the correlation excuse from money managers. (WSJ)

Expect more me-too ETFs in 2012. (ETFolution)

Economy

More good jobs news. (Money Game, Carpe Diem)

Who are the long-term unemployed? (The Atlantic)

What is the Fed going to do if the economy turns out to be better than expected? (Tim Duy)

The secular trend for economic growth is down, down, down for the developed world. (Floyd Norris)

Does manufacturing need special treatment? (NYTimes)

Earlier on Abnormal Returns

Top clicks this week on Abnormal Returns. (Abnormal Returns)

What you missed in our Saturday long form linkfest. (Abnormal Returns)

Super Bowl

How Indianapolis used sports to transform itself. (New Geography)

The one sure winner from the Super Bowl: Lucas Oil. (LiveScience)

The Super Bowl is over (usually) when this happens. (WSJ)

Abnormal Returns is a founding member of the StockTwits Blog Network.