In case you didn’t know it already today, March 9th, is the third anniversary of the stock market low reached during the financial crisis and the ongoing three year bull market. Eddy Elfenbein at Crossing Wall Street notes this anniversary:

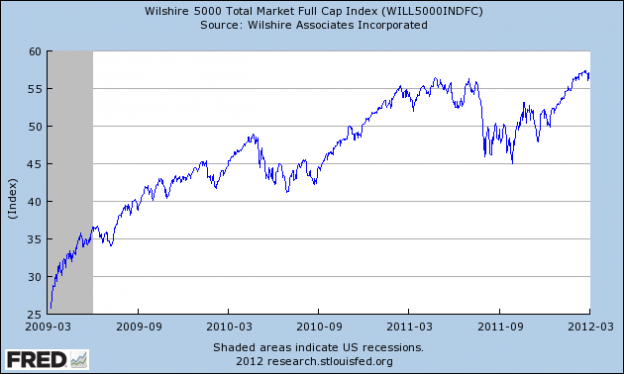

This has been one of the great bull runs in market history. Going by the Wilshire 5000 Total Market Full Cap Index, the market is up 121.43% through yesterday.

You can see in the below graph how this bull market has played out:

Source: FRED

While this post’s title may be an exercise in hyperbole it accurately represents the behavior of most individuals towards this market. Not that many investors have participated throughout. Josh Brown at The Reformed Broker a week ago noted that only recently had individual investors begun putting money back into equity mutual funds that they had been consistently been pulling out for years.

Despite the upward run stocks have had over the past three years it has come with a fair amount of volatility. 2011 was filled with what Floyd Norris at the New York Times called “excess volatility” or volatility that doesn’t really take the stock market much in either direction for long. This volatility has been a deterrent for many investors to jump back in. From an article by Whitney Kisling in Businessweek:

“What you’re seeing is a gigantic exercise in behavioral finance,” says Brian Barish, president of Cambiar Investors, referring to studies that show investors feel the pain of losses more intensely than the pleasure of gains. “The ability to scare the hell out of people is much greater than the ability to attract them to equities.”

Stephen Dubner at Freakonomics looks at these last three years of additional evidence of individual risk aversion. Indeed one of the arguments in my forthcoming book is that individuals because they are by and large risk averse need almost to be tricked into taking on financial risk. The financial services industry tries to elide that risk in various ways, but in the end it usually takes higher prices to make investors feel confident (and safe) enough to put money on the line in a particular asset.

For this very reason investors need to have in place a portfolio strategy that recognizes our inherent desire to bull high and sell low, i.e the behavior gap. Individual investors, who aren’t on the “inside”, need to recognize that stuff happens, good and bad, that we can’t forsee. Interloper writes:

Unexpected things, bad things, will happen that we never see coming. Conversely, we are likely to trail the index for significant periods of time because we “missed” something. Outsider psychological well being, I think, is dependent more on the acceptance of this fact than any other. To fight it is to open the door to a “headless chicken” investment style that is more likely to buy a yacht for your broker than yourself.

Undoubtedly investors are taking note of the ongoing bull market wondering what to do next. Roben Farzad in Businessweek gives these investors a measure of cold comfort:

So if you missed out last time, take heart; you’re not alone. If history and human nature are any indicators, investors will dive back in, and with gusto, only after the market surges way past these levels.

Unfortunately for most investors this will likely be the case. The market will serve to frustrate investors who approach it with no coherent plan. Our ongoing battle isn’t with the market, indeed one could argue that there has never been a better time to be an individual investor, the battle is with ourselves and our psychology. Investors therefore have to have in place a workable plan before they miss out on the next three year bull market.

Items mentioned above:

121.43% in three year. (Crossing Wall Street)

Reverse the streams! Equity fund flows goes positive. (The Reformed Broker)

Market volatility and change may be afoot. (NYTimes)

The bull market turns three. Where’s the party? (Businessweek)

We are living in a loss averse world. (Freakonomics)

The behavior gap illustrated. (Abnormal Returns)

You missed the epic bull market. You are not alone. (Businessweek)

There has never been a better time to be an individual investor. (Abnormal Returns)