Quote of the day

Eddy Elfenbein, “(T)rading foreign currency is a terrible idea for individual investors. It’s a zero-sum game and you most likely won’t win…If you’re saving for your retirement, trust me, stay away from forex.” (Crossing Wall Street)

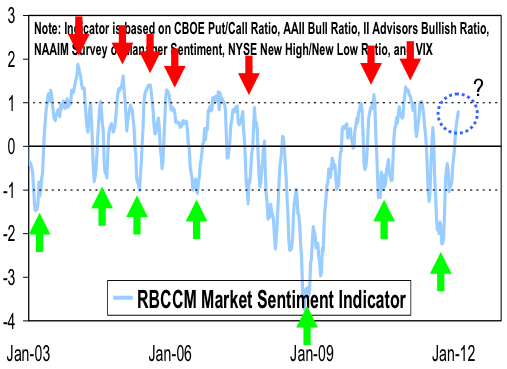

Chart of the day

Investor sentiment is getting elevated. (Money Game)

Markets

The supply and demand situation for shares is still favorable. (Capital Observer)

Breadth is weakening ever so slightly. (Bespoke)

Don’t give up on defensive stocks just yet. (MarketBeat)

$VIX ETNs are the tail wagging the dog. (FT Alphaville also VIX and More)

Strategy

Now is NOT a good time to be an individual investor. (Aleph Blog)

Why a stock’s actual price doesn’t matter. (Joe Fahmy)

Do low stock correlations necessarily make for good times for stock pickers? (Symmetric Information)

How to apply game theory to investing. (Minyanville)

Managers

Tracking the returns of under-the-radar “super investor” Kevin Douglas. (Compounding My Interests)

Who is Allan Mecham and how did he put up eye-popping returns? (SmartMoney)

Technology

Why Apple ($AAPL) should build its own social network. (ReadWriteWeb)

Google ($GOOG) is now a conglomerate. (Breakingviews)

Amazon ($AMZN) quickly took market share in the tablet market with the Fire. (AllThingsD)

The odds are against Facebook living up to the high expectations. (Aswath Damodaran also Pragmatic Capitalism)

Why Pinterest should file for an IPO. (Term Sheet)

Companies

Why big pharma needs to offer high dividend yields. (research puzzle pix)

Lessons learned from the Diamond Foods ($DMND)-Pringles debacle. (Dealbook)

Finance

RICO+Libor=Trouble. (Finance Addict)

Moody’s ($MCO) on the investment banks: when in doubt, downgrade. (Deal Journal)

Why do elite liberal arts majors head to Wall Street? Because they have no real marketable skills. (Ezra Klein)

Funds

Why are investors so willing to pay a premium for Bill Gross-managed closed-end bond funds? (Bloomberg)

More “super income” ETFs coming to a trading screen near you. (IndexUniverse)

Bond ETF granularity: here come sector funds. (IndexUniverse, iShares Blog)

Interesting paper on how regulation has diminished the advantages of big mutual fund complexes. (SSRN)

Global

Why Europe is p*ssed at Greece. (Money Game)

When is the day of reckoning for Japan? (Fortune)

How much time does China have to transform its economy? (Planet Money)

Economy

Weekly initial unemployment claims continue to trend lower. (Calculated Risk, Money Game, Bespoke)

The tug of war going on at the Fed. (Mark Thoma)

Earlier on Abnormal Returns

Identifying talent is only easy in retrospect. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

StockTwits is getting more conversational. (StockTwits, TechCrunch)

Macintosh software is going to get more iPhone-like. (WSJ, Daring Fireball)

Jeremy Lin: when our models are wrong. (Huffington Post)

Abnormal Returns is a founding member of the StockTwits Blog Network.