Quote of the day

Morgan Housel, “The only consistent way average people can make money in stocks is to let company profits and dividends accrue over time. ” (Motley Fool)

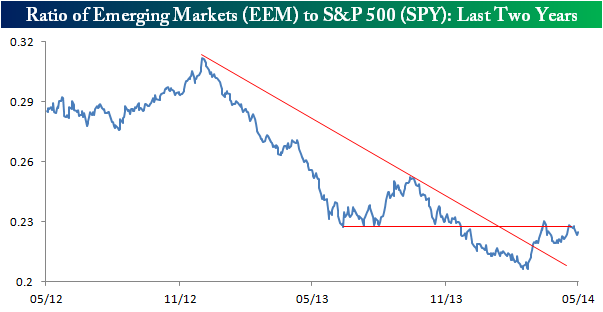

Chart of the day

Putting the emerging markets rally into perspective. (Bespoke)

Strategy

Volatility has disappeared. (Buttonwood’s notebook, The Reformed Broker)

Can you use profit margins to pick stocks? (Millenial Invest)

Data is cheap. Meaning is expensive. (Above the Market)

Manager selection

Cullen Roche, “Economists tend to have a totally different mindset than asset managers.” (Pragmatic Capitalism)

Some steps on putting an investment strategy under the microscope. (Humble Student of the Markets)

Apple

Apple ($AAPL) buys Beat. But what are they buying? (Om Malik, WSJ, Quartz, Vox)

Apple is now a multi-platform company with Beats Music. (TechCrunch, Medium)

Why Apple hasn’t gotten into the TV business in a big way yet. (Business Insider, Benedict Evans)

Jimmy Iovine is a breath of fresh air at Apple. (Bits, NYTimes)

Finance

Bill Ackman wants to launch a publicly traded hedge fund. (Dealbook)

The Ziff brothers are shutting down their big, high profile hedge funds. (WSJ)

Pay for performance often just means “pay” these days. (Businessweek)

Big banks are facing two big profit headwinds. (WSJ)

Funds

Remember that there is a difference between an index and the ETF that tracks it. (ETF)

Why Blackrock ($BLK) won’t do leveraged ETFs. (Reuters)

What is in Larry Swedroe’s portfolio: adapted from Reducing the Risk of Black Swans: Using the Science of Investing to Capture Returns with Less Volatility. (ETF)

Global

A volatile middle class is the source of new global political risks. (FT Alphaville, ibid)

Should everyone chill out about India. (Fortune)

The case for eliminating paper currencies. (FT also Time)

Some follow up on the data issues issue with Thomas Piketty’s Capital in the Twenty-First Century. (FT Alphaville)

Economy

The US economy shrank more in Q1 than previously thought. (Vox, Calculated Risk, Real Time Economics, MoneyBeat)

Construction lending has stopped going down. (Real Time Economics)

The sharing economy is not hurting the economy. (Pragmatic Capitalism, EconLog)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Charles Sizemore, “Clash of the Financial Pundits is a must read for anyone who enjoys financial media.” (Sizemore Insights)

The experience of Soylent, the much hyped meal substitute, sounds unpleasant. (Farhad Manjoo, ArsTechnica)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.