Quote of the day

Rick Ferri, “Markets do not reflect the average beliefs of market participants.” (Rick Ferri)

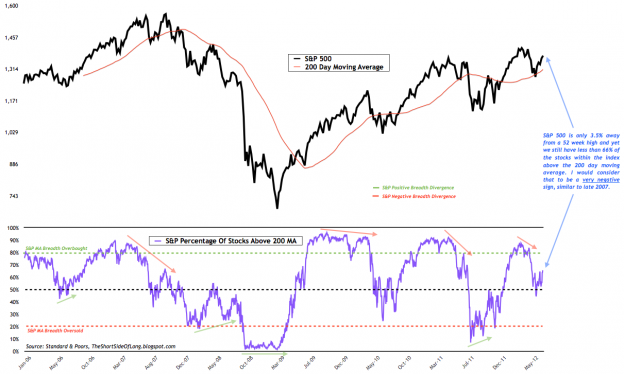

Chart of the day

Is the S&P 500 setting up a negative divergence? (The Short Side of Long)

Markets

Why the US dollar is soaring. (Money Game)

Global equity markets have been tightly bunched YTD. (Capital Spectator)

Putting the move in corn into some perspective. (VIX and More)

Momentum works just not during periods of high volatility. (Mark Hulbert)

There’s no bond bubble. (Income Investing)

Strategy

Managed futures returns have been disappointing of late. (Institutional Investor)

What is a half-and-half options strategy? (Barron’s)

In praise of the 60/40 portfolio. (LearnBonds)

What is the best preparation to be a trader? (SMB Training)

Companies

Would a drop in corporate profits get companies to invest more? (Fortune)

Manchester United is going public, but shareholders won’t have much of a say. (FT also WSJ, The Source, Globe and Mail)

The iPhone is boring. Next! (Slate)

Finance

How much longer can US markets tolerate a two-tiered trading system? (FT)

The public phase of the Libor scandal is really just getting underway. (WSJ contra Aleph Blog)

Blackrock’s ($BLK) acquisition phase is likely over. (Bloomberg, ibid)

Some big name hedge fund managers are setting up their firms for after their retirement. (Institutional Investor)

Financial advice

Financial adviser vs. financial advisor: does it matter? (Total Return)

How should we judge financial adviser performance. (Capital Spectator)

Are financial frauds predictable? (Turnkey Analyst)

Is the cloud appropriate for client data? (Nerd’s Eye View)

ETFs

On average ETFs are a better bet than mutual funds. (Big Picture)

Investors are pouring record amounts into ETPs. (FT)

Ten surprising mid-year ETF stats. (ETFdb)

Sorting through the China ETFs. (IndexUniverse)

Global

China, the UK and the ECB all ease monetary policy. (FT, Telegraph, FT Alphaville)

The Australian dollar is overvalued. (MacroBusiness)

Economy

ADP private payrolls jump in June also weekly initial unemployment claims (Calculated Risk, ibid also CBP)

The ISM services report for June disappoints. (Bloomberg, Real Time Economics, Bespoke)

Why all the focus on fiscal policy? In some real ways the economy is getting better. (A Dash of Insight)

Some long term optimism for the US economy. (Humble Student)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

What you missed in our Independence Day links. (Abnormal Returns)

Mixed media

Everybody is talking about RebelMouse. (SAI)

Why the discovery of the Higgs boson matters. (Slate)

As mistakes go this one was pretty cool: San Diego shoots off all its fireworks at once. (Atlantic Wire)

Abnormal Returns is a founding member of the StockTwits Blog Network.