Quote of the day

Fred Wilson, “It goes back to optimizing versus satisficing. If you want to find the optimal entry price or the optimal exit price, you will drive yourself crazy. I prefer to find an acceptable price. And I think that averaging in and averaging out does that for you.” (A VC)

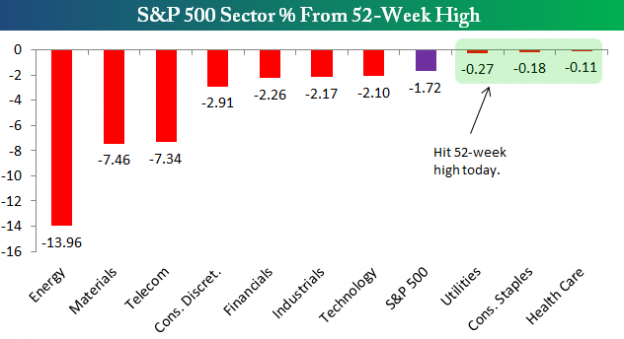

Chart of the day

Where various sectors sit relative to their 52-week highs. (Bespoke)

Commodities

The case for corn. (Andrew Thrasher)

Are gold miners a value trap? (ETF)

Natural gas liquid (NGL) trading volume is picking up. (WSJ)

Strategy

Bond markets are a lot smarter than equity markets. (Alpha Architect)

Why high yield bond investors should pay attention to the stock market. (CSSA)

Is factor investing useless? (Pragmatic Capitalism)

Why we shouldn’t be too worried about data-mined research results. (Noah Smith)

Some more words that need to be banned from the finance lexicon. (A Wealth of Common Sense)

Companies

Can Amazon ($AMZN) ever be profitable? (Musings on Markets)

Fast followers, like Samsung, eventually flag. (Asymco)

Finance

Kid Dynamite, “(T)here will never be a time when you – the retail investor – are the first to read, understand and react to a news story.” (kid Dynamite)

What the major online investment advisors charge. (Meb Faber)

Why aren’t corporate bonds more standardized? (FT)

ETFs

The ten cheapest country ETFs. (ETF)

Not all biotech ETFs are created alike. (ETF)

Economy

Weekly initial unemployment claims continue to fall. (Bloomberg, Calculated Risk)

Q3 GDP rose at a 3.5% rate. (Wonkblog, Calculated Risk, Crossing Wall Street)

QE

What did QE accomplish? (The Upshot, WSJ,

With the end of QE the FOMC’s statement is going to shrink. (Real Time Economics , Aleph Blog)

2015 could be the year of the rate hike. (Tim Duy)

Earlier on Abnormal Returns

Q&A with Tobias Carlisle author of Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations. (Abnormal Returns)

Building your personal margin of safety. (Abnormal Returns)

Q&A with Wes Gray of Alpha Architect and the ValueShares US Quantitative Value ETF ($QVAL). (Abnormal Returns, part 2)

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Space travel has never been, and never will be, risk-free. (New Yorker)

Solar flares are messing with communications. (WSJ)

The surprising answer to: what do firefighters do all day? (Vox)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.