Quote of the day

William MacAskill, “Do something valuable.” (Quartz also Fast Company)

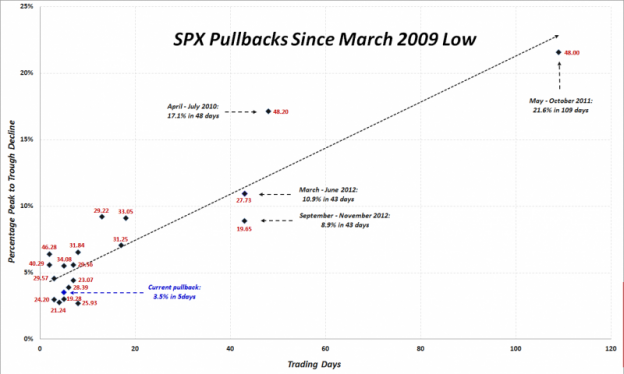

Chart of the day

S&P 500 pullbacks during the current bull market. (VIX and More)

Markets

Three signs we are in a risk-off phase. (Charts etc.)

This is what distribution looks like. (The Reformed Broker)

Distribution vs. sentiment. (Phil Pearlman)

Why volatility could tick up. (SurlyTrader)

Energy

Why is crude oil tanking? (Sober Look)

The bottom in natural gas is in. (All About Alpha)

The shale gas revolution is driving all sorts of industrial activity. (FT)

Strategy

Do “socially aware” traders outperform? (FT)

The so-called ‘new normal‘ never really was. (I Heart Wall Street)

Just how useful is the Market cap/GDP ratio? (Monevator)

The “behavior gap” illustrated. (Money Game)

Companies

The enterprise value of Apple, Google and Microsoft are now pretty close. (Avondale Asset)

Why Yahoo! ($YHOO) stock is still cheap. (TheStreet)

Can FUEL drive Nike ($NKE)? (Howard Lindzon)

The bear case on Apple ($AAPL). (Forbes)

Why Apple isn’t interested in price-sensitive customers. (Daring Fireball)

Finance

Why should anyone continue to invest in equity long/short strategies? (HFI via @stockjockey)

Goldman Sachs ($GS) is mum about how risky its assets are. (Fortune)

Analyst recommendations are a coin flip. (The Reformed Broker)

Funds

Gold ETFs worked pretty much as they were supposed to. (WSJ)

Core bond funds are doing their own version of yield chasing. (Morningstar)

Global

The yield on all manner of Euro government bonds has plunged. (MoneyBeat)

On the causality between growth and debt. (Felix Salmon)

Economy

Weekly initial unemployment claims ticked up. (Calculated Risk, Capital Spectator)

Is the Fed just blowing another bubble? (Propublica)

On the prospect for a decade of low interest rates. (Real Time Economics)

Mixed media

In times of trouble why it makes sense to take a Twitter break. (Pando Daily)

What kinds of food are caffeinated these days? (WSJ)

The best (and worst) airports. (Freakonomics)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.