Quote of the day

The Investor, “Buying at cheap to fair value is what drives good long-term returns. Not waving your hands above a darkening crystal ball.” (Monevator)

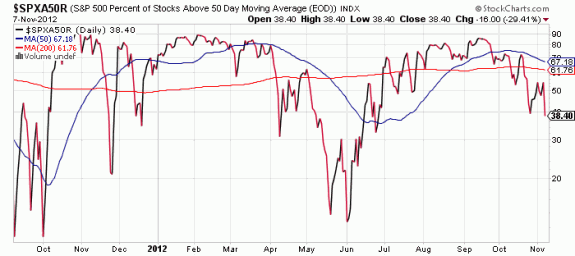

Chart of the day

The S&P 500 is nowhere near oversold. (Market Montage)

Markets

Why do 2% down days surprise us? They shouldn’t. (The Source)

This is not a healthy market. (TheArmoTrader)

Earnings projections are still coming down. (Crossing Wall Street)

How to trade a stall in fiscal cliff negotiations. (Condor Options)

Strategy

A look at those countries with the lowest CAPEs. (World Beta)

Why you shouldn’t change your portfolio strategy on capital gains tax speculation. (Vanguard)

There is more to investment-related taxes than just capital gains. (Rick Ferri)

Strategic Asset Allocation: The Global Multi-Asset Portfolio (1959-2011). (SSRN via @quantivity)

Michael Mauboussin talks with Michael Covel about his new book The Success Equation: Untangling Skill and Luck in Business, Sports and Investing. (iTunes)

Companies

McDonald’s ($MCD) sales drop for the first time in nine years. (Bloomberg, Zero Hedge)

What Carl Icahn sees in Netflix ($NFLX). (YCharts Blog)

What should companies have to disclose if they are preparing for bankruptcy? (WSJ)

We are closer to the day when Corporate America can stop complaining about “uncertainty.” (Term Sheet)

Apple ($AAPL) could do a lot of things with ARM chips that don’t involve Macs. (ReadWrite)

The biggest risk facing Apple: retaining its best people. (Slate)

Finance

Can corporate bonds ever truly serve as a ‘safe haven‘? (BondSquawk)

Sometimes you have to look closely at the message of the corporate bond market. (Dealbreaker)

Fidelity 401(k) balances reach a new high. (Bloomberg)

iNAV trading would be a big deal. (Institutional Investor)

Global

Can European industry compete against an America fueled by cheap natural gas? (FT)

UK pension funds are running out of Gilts to purchase. (FT)

China, on the whole, is not deleveraging. (FT Alphaville)

Will India ever make a much hyped infrastructure push? (Quartz)

Economy

The US economy is not done deleveraging. (Free exchange)

Where might the unemployment rate be in four more years? (Quartz)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Technology

Why Twitter has become a go-to new source. (SplatF also Wired)

On the existential threat facing the cable companies. (SAI)

How to devise passwords that drive hackers away. (NYTimes)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.