Quote of the day

Scott Krisiloff, “If we are leaving the 20th century behind, then maybe we have to leave behind our concept of fair returns on investment. Dividends are one signal telling us to lower our expectations.” (Avondale Asset)

Chart of the day

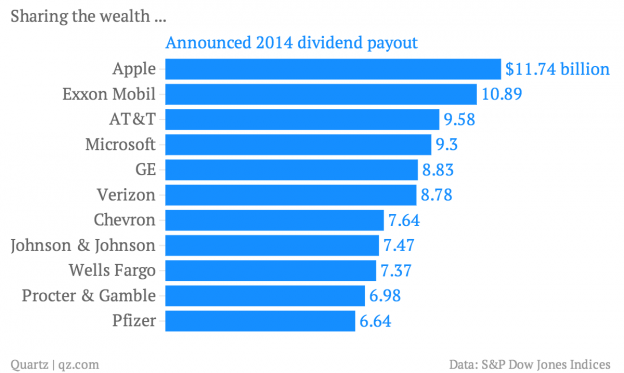

Apple is now the world’s biggest dividend payer. (Quartz)

Markets

David Einhorn’s bubble call is premature. (Barry Ritholtz, Random Roger)

Mom and pop are once again trading stocks. (WSJ)

Bullish sentiment is ticking back up. (Bespoke)

Commidities

Pension funds are sniffing around commodities again. (FT)

Why there are no liquid milk futures. (Attain Capital)

How El Niño affects certain commodities markets. (MoneyBeat)

Strategy

Andrew Thrasher, “Many traders that I know and have a great respect for are deeply and passionately focused on the details.” (AThrasher)

In praise of systematic decision making systems. (Turnkey Analyst)

Apple

Apple’s ($AAPL) earnings report had something for everyone. (Business Insider, WSJ, ReadWrite, Daily Ticker, Brian Lund)

What would you do if you were Tim Cook and had $151 billion to spend? (Estimize Blog)

Apple was against stock splits until it was for them. (MoneyBeat earlier Bloomberg)

Companies

Amazon ($AMZN) now wants to fill your pantry with Prime Pantry. (Pando Daily, Engadget)

Why the big technology companies pay up for disruptive startups. (Quartz)

If every drug maker was like Valeant ($VRX) we would soon run out of new drugs. (John Gapper)

Finance

Why two “insider traders” should get their convictions overturned. (Matt Levine)

How common do CFOs “misrepresent earnings“? (Turnkey Analyst)

Catastrophe bonds are attracting more interest. (WSJ)

The lowdown on stock splits. (Points and Figures, Kid Dynamite)

Global

Numericable issued a record €7.9bn slate of junk bonds. (FT)

Japan’s shipyards are busy once again. (Bloomberg)

The key to German company success. (Quartz)

Economy

The US Economic Activity Surprise Index is soaring post-weather blues. (@greg_ip)

Weekly initial unemployment claims ticked up last week. (Calculated Risk)

Why the housing market has slowed. (Real Time Economics, Sober Look)

Why the utilities are none too happy with solar. (Daniel Gross)

Automakers are having tough time getting their cars delivered. (WSJ)

A Cliff Notes version of Thomas Piketty’s Capital in the Twenty-First Century. (Justin Fox)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

The idea of “breaking news” has gotten a bit stretched these days. (USA Today)

The rise of the sharing economy “is not just an economic breakthrough. It is a cultural one..” (Wired)

What you need to know about big data to keep your job. (Daniel Nadler)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.