Quote of the day

Tom Brakke, “I don’t care what you believe. But you have to convince me that it’s something more than faith and something greater than luck. No matter what tribe you come from.” (research puzzle pieces)

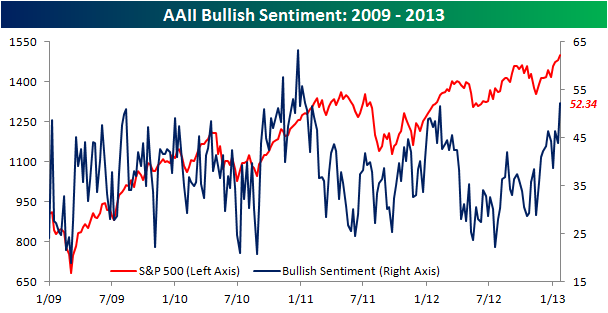

Chart of the day

Investors are getting pretty bullish. (Bespoke)

Strategy

Ray Dalio on where cash will go in 2013. (Market Folly)

Why have investors underestimated Carl Icahn? (Kiplinger’s)

Warren Buffett pulls ahead in in his stocks vs. hedge funds bet. (Fortune)

Companies

Netflix ($NFLX) surprises to the upside. (TechCrunch, WSJ)

What would Michael Dell do different with a private Dell ($DELL)? (SAI)

Spinoff alert for Starz Network ($STRZA). (SumZero)

Apple ($AAPL)

An Apple earnings dashboard. (SplatF also Quartz)

Apple: resetting expectations. (SAI, Herb Greenberg)

People are clamoring for new Apple products to drive growth. (Breakingviews)

There is no such thing as tech value stock. (The Reformed Broker)

Does Apple have a form factor problem? (Jeff Matthews)

Maybe it has an iTunes and China problem? (Eric Jackson)

The case for an Apple comeback. (Adam Lashinsky)

Finance

Disaster reinsurance may be one of the few truly non-correlated assets. (Dealbook)

Financials still look good. (The Brooklyn Investor)

The SEC is getting a “aggressive” prosecutor as its new chair. (Quartz)

Funds

The “bond kings” are rotating into equities. (The Reformed Broker)

MLP ETPs are far removed from actually owning MLPs. (IndexUniverse)

Don’t forget that as ETFs rebalance their holdings (and risk profile) can change sometimes dramatically. (Morningstar)

Global

China’s manufacturing is picking up. (beyondbrics)

Euro flash manufacturing PMIs are turning up. (FT Alphaville)

Economy

Weekly initial unemployment claims are nearing pre-recession levels. (Calculated Risk, Bespoke)

The wealth effect is more of a real estate than stock market effect. (Real Time Economics also Bucks Blog)

Does income bring happiness? (Conversable Economist via EV)

Earlier on Abnormal Returns

Apple is STILL a megacap. (Abnormal Returns)

Mixed media

Why luck will play a bigger role in a shortened NHL season. (HBR)

Twitter as a learning tool. (Scientific American)

Some restaurants are now prohibiting food photography. (NYTimes)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.