This is an early (and abbreviated) edition of the linkfest. We will get back to our regular schedule shortly.

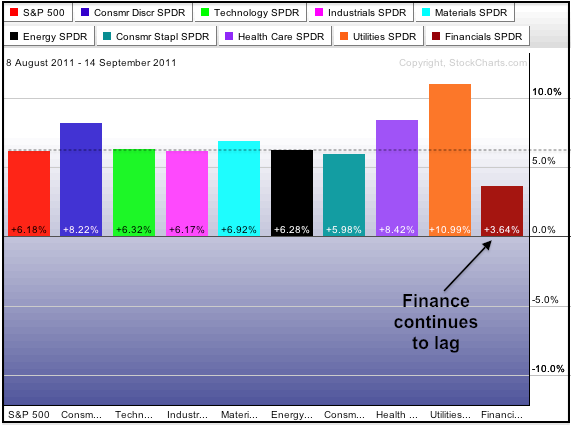

Chart of the day

Finance sector just cannot catch a break. (StockCharts Blog)

Markets

Looking to get long for a trade. (Big Picture)

47% of S&P 500 stocks yield more than the 10 year Treasury. (Bespoke)

Investment grade corporates provide a yield advantage but at what cost? (FT Alphaville)

Tough times for industrial stocks. (Bespoke)

Strategy

Checking back in on the silver market. (Market Anthropology)

How to play a better than expected scenario in Europe. (A Dash of Insight)

Bill Ackman is venturing afield in his Hong Kong dollar play. (market folly, Bloomberg)

Why you should ignore your 401(k) balance. (Felix Salmon)

Money management

The early history of John Bogle and the index fund. (Falkenblog)

Fidelity Magellan as an abject example of the challenges of money management. (The Reformed Broker)

Quant hedge funds have an advantage when it comes to succession. (Dealbook)

Enhanced beta is the new alpha. (IndexUniverse)

Companies

What does Android market share mean to Google ($GOOG) profitability? (SplatF)

Who isn’t involved in the much rumored Yahoo ($YHOO) sale? (AllThingsD)

Don’t expect a Facebook IPO for another year or so. (FT contra Term Sheet)

Finance

UBS reports a $2 billion loss based on ‘rogue trades.’ (WSJ, FT, Clusterstock, FT Alphaville, The Source)

Leveraged lending is back, sorta. (WSJ)

Are public pensions still too exposed to equities? (WSJ)

Global

George Soros on the highly uncertain future of the Euro. (Reuters)

CDS prices now put a French default ahead of a California default. (Bespoke)

On the Euro funding crisis. (Macro Man, SurlyTrader)

Economy

What are retail sales telling us at the moment? (macrofugue)

The jobs crisis began in 2001. (Ezra Klein also Economist’s View)

Mixed media

The 2011 FT/Goldman Sachs Business Book of the Year shortlist is out. (FT)

How “Return of the Jedi” lost money according to Hollywood accounting. (The Atlantic)

College kids these days are mostly talk. (LiveScience)

Abnormal Returns is a founding member of the StockTwits Blog Network.