Quote of the day

Colin Read, “We may never return to primary reliance on fundamental analysis and computer-aided trading…If the history of such technology tells us anything, it’s that we can expect more meltdowns.” (Bloomberg)

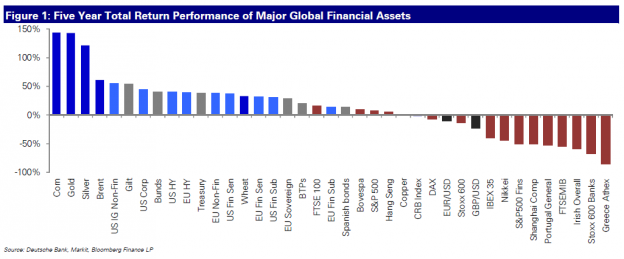

Chart of the day

How have major asset classes performed five years in from the financial crisis. (FT Alphaville)

Markets

There was some serious ugliness going on five years ago in the financial markets. (MarketBeat, Globe and Mail)

Why we should pay no heed to uncertain, 19th century equity returns data. (Big Picture)

Individual investors are getting more bullish. (Bespoke)

This is what sector rotation looks like. (Investing With Options also Bespoke)

A look at stock vs. bond relative performance. (Crossing Wall Street)

A look at the relative valuation of investment grade and high yield bonds. (Learn Bonds)

Strategy

What measures do the best job in identifying cheap stocks? (Turnkey Analyst)

Complex companies deserve a big valuation haircut. (Aleph Blog)

Picking the brain of David Merkel. (Minyanville)

Finance

More detail on just how stock Knight Capital ($KCG) was carrying around due its mistake. (Kid Dynamite, WSJ)

Carlyle Group ($CG) to purchase asset manager TCW. (WSJ, Dealbook)

Bond trading is becoming ridiculously difficult. (Bloobmerg)

How to run an IPO road show. (HBR)

Hedge funds

Count Paul Singer of Elliott Associates as another frustrated investor. (Reuters)

John Paulson is betting big on a rebound in Las Vegas real estate. (Deal Journal)

How to name your hedge fund. (Market Folly)

ETFs

Low ETF expenses don’t matter if your fund is expensive to trade. (IndexUniverse)

What to do when your ETF is closing. (Invest With an Edge)

A slew of active currency ETFs are coming to market. (IndexUniverse)

Global

The dilemma facing China as its economy slows. (FT Alphaville, FT)

European stocks are still cheap. (Pragmatic Capitalism)

Two economists who vehemently disagree on the future of the Euro. (Fortune)

Economy

Weekly initial claims have flatlined. (Calculated Risk, Capital Spectator)

A real-time economic indicator flashing caution. (Bonddad Blog)

Is the Fed losing control of the long end of the curve? (MarketBeat)

Earlier on Abnormal Returns

Real companies pay dividends. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Psychology

How not to get tripped up by the replacement heuristic. (Leigh Drogen)

How can investors work against their inherent over-optimism. (The Psy-Fi Blog)

How fear drives productivity gains. (Businessweek)

Mixed media

A Roger Lowenstein review of Joe Carlen’s The Einstein of Money: The Life and Timeless Financial Wisdom of Benjamin Graham. (WSJ)

The top 10 mobile apps on Wall Street. (Wall Street & Technology)

In praise of the new, slower Digg. (Slate)

Abnormal Returns is a founding member of the StockTwits Blog Network.