A couple of classic books for the holidays: Thinking Fast and Slow by Daniel Kahneman and The Checklist Manifest: How to Get Things Right by Atul Gawande.

Quote of the day

J. Carlo Cannell, “Your brand is, and remains, tremendous. I commend you for your tenacity and intellect, but you are simultaneously an employee of CNBC and a director, major shareholder and employee of TST. To which entity do you ascribe your greater allegiance? There would appear to be a grand structural conflict.” (SEC)

Chart of the day

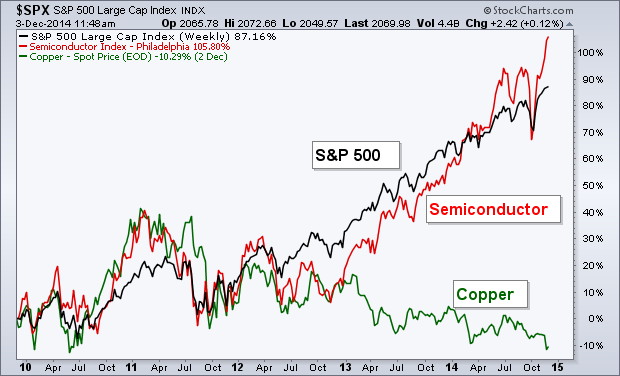

Semiconductors have taken over for copper as a market bellwether. (Andrew Thrasher)

Markets

Signs of weakness below the surface of the stock market. (TraderFeed)

How have V-bottoms played out in the past? (Dana Lyons)

The case for a rebound in oil prices. (The Fat Pitch)

Strategy

Why low volatility seems to work. (Businessweek)

Two interesting papers on the cross-section of expected stock returns. (SSRN, ibid)

Why investors need not mess with asset classes other than stocks and bonds. (Optimal Momentum)

Companies

Why IBM ($IBM) is missing out by not pushing Watson harder. (MicroFundy)

TheStreet.com

TheStreet.com ($TST) and Jim Cramer have attracted an activist investor. (Dealbook)

What’s the end game for TheStreet.com? (Aleph Blog)

Finance

Wall Street analysts love to join up with private equity shops. (Dealbook)

Investment banks are cozying up to Uber prior to an IPO. (Quartz)

Finance is the worse for wear for not having more women in executive roles. (John Gapper)

Does carried interest appear in the Bible? (Private Equity Beat)

ETFs

NY Life is buying ETF provider Index IQ. (ETF)

Global

A short-list for the charts of the year. (Quartz)

The Fed and the ECB view the oil shock differently. (Gavyn Davies also The Upshot)

Emerging markets are not as weak as commonly thought. (Bloomberg View)

Economy

Weekly initial unemployment claims continue to trend below 300k. (Calculated Risk)

The Fed is still on track for a rate hike in 2015. (Tim Duy)

Don’t count on a huge surge in consumer spending due to lower gasoline prices. (Capital Spectator)

Earlier on Abnormal Returns

Uber: too big to ignore for public market investors. (Abnormal Returns)

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

MBA programs are leaving room for late applicants. (WSJ)

B-schools are now bragging about how much VC money their alums are raising. (WSJ)

Entrepreneurship is why Stanford tops this list of MBA programs. (Fortune)

You can support Abnormal Returns by visiting Amazon, signing up for our daily newsletter or following us on StockTwits, Yahoo Finance and Twitter.