Quote of the day

Jonathan Burton, “We tend to forget that investment professionals are hired hands. They are consultants, nothing more — and you don’t have to take their advice. It’s your money.” (Marketwatch)

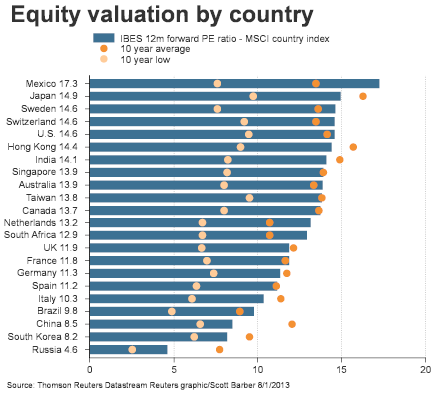

Chart of the day

The US is one of the more expensive global stock markets. (Horan Capital)

Markets

What say the Value Line Median Appreciation Potential measure for stocks? (Unexpected Returns)

A look at the recent performance of some notable asset allocation strategies. (Mebane Faber Research)

Crude oil has broken out. (The Short Side of Long)

Strategy

Advice for an undeperforming fund manager: stick with your discipline. (Humble Student)

A dozen things learned from George Soros. (25iq)

If you are trading for the money you are doing it wrong. (Rogue Traderette)

Research

Is a 3% withdrawal rate the new 4%? (Rekenthaler Report)

Don’t make financial decisions when you are sad. (Turnkey Analyst)

Do firms issue more equity when markets are more liquid? (SSRN)

Companies

How is Air Products ($APD) going to respond to Bill Ackman? (Dealbook)

Ford ($F) pickup sales are at a 7-year high. (Bespoke)

Gold miners, like Barrick Gold ($ABX), are coming to terms with lower gold prices. (Globe and Mail also SRS)

Finance

What are we to make of SAC Capital’s returns now? (FT)

Big data is the new focus of funds, not raw trading speed. (MoneyBeat)

Goldman Sachs ($GS) is reluctant to give up its private equity arm. (Quartz)

Why Blackstone ($BX) wants to extend its reach into the retail market. (YCharts Blog)

Funds

The Mutual Fund Observer commentary for August is up. (Mutual Fund Observer)

iShares is joining the currency ETF game. (Random Roger, IndexUniverse)

Blackrock is expanding their suite of target date maturity bond funds. (InvestmentNews)

The Nashville Area ETF ($NASH) is now live. (NPR)

Global

The case for optimism in Europe. (FT Alphaville, BI)

What are we to make of the divergence in China PMIs? (FT Alphaville)

Growth is picking up in South Korea. (Bonddad Blog)

The case for lower global growth for the foreseeable future. (Quartz)

Economy

Weekly initial unemployment claims are creeping lower. (Calculated Risk, Bespoke)

The ISM Manufacturing report for July shows strong growth. (Calculated Risk, Bespoke, BI)

Checking in on the new housing boom. (Pragmatic Capitalism)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Finance media

Happy second blogiversary! (Above the Market)

How to become a go-to market media source. (Behind the Headlines)

Mixed media

Eat your fruit. (Bits)

8 ways to get happier at work. (Fast Company)

When everything is online, everything is hackable. (Scientific American)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.