Quote of the day

Joel Greenblatt, “Very few hedge funds in the long run can justify their fees.” (Marketwatch)

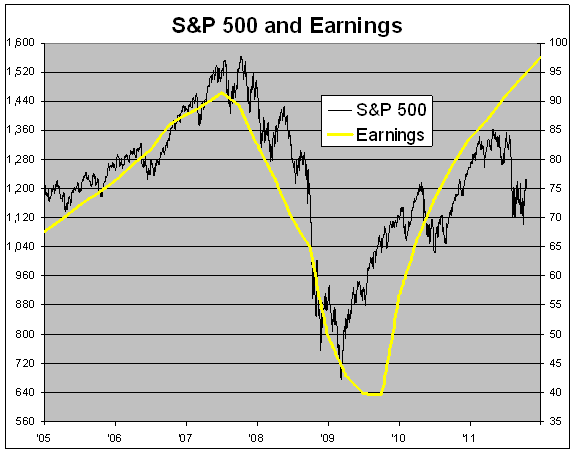

Chart of the day

Multiple contraction is a b*tch. (Crossing Wall Street)

Markets

Putting current market volatility into perspective. (MarketBeat)

Periods of high commodity prices and low inflation expectations are hard to find. (Market Anthropology)

Is the Brent-WTI spread ever going to narrow? (Bespoke)

Does the S&P 500 exhibit seasonality? (Portfolio Probe)

Today’s macro environment is creating misvaluations. (Aleph Blog)

Strategy

Why you can’t short using the Magic Formula. (Turnkey Analyst)

Do regular account statements make clients nervous? (Nerd’s Eye View)

What your broker went though to get where he is today. (I Heart Wall Street)

What neuroscience tells us about our reactions to financial situations. (CXO Advisory Group)

Companies

The long term case for Intel ($INTC). (Phil Pearlman)

Good luck, Yahoo! ($YHOO). (Deal Journal)

The Man Group can no longer ignore the US. (Dealbook)

The ducks are quacking. Quicksilver Resources ($KWK) is forming an MLP. (Deal Journal)

Apple

Is the tablet market really going to overtake the PC market? (SplatF)

Peak Apple Store? (Jeff Matthews)

Investors now need to worry about Apple ($AAPL) missing earnings expectations. (YCharts)

Finance

Why money market mutual fund reform is taking so long. (CBS Moneywatch)

If you think sell-side analysts are paid to be right you are sorely mistaken. (The Interloper, ibid via TRB)

Has Goldman Sachs ($GS) lost its mojo or is it simply preparing for the Volcker Rule? (Freakonomics)

Do we really want banks to be buying back their shares? (Reuters)

ETFs

ETFs under SEC review. (WSJ, IndexUniverse, Random Roger)

New low volatility ETFs launch with low expenses to boot. (ETFdb)

Is there really much difference between a mid cap index and an equal-weighted S&P 500 ETF? (Morningstar)

The local currency emerging market bond ETF space is getting crowded. (IndexUniverse)

Global

For those still interested: EFSF stuff. (MarketBeat, FT Alphaville)

Italian bond yields are back above 6%. (Credit Writedowns, Pragmatic Capitalism)

FX reserve growth in China has stopped. (FT Alphaville)

Economy

More of the same on the jobless claims front. (Calculated Risk, Capital Spectator)

ECRI vs. Wall Street: who is right? (Marketwatch)

Good news. Christmas sales track well with back-to-school sales. (Crackerjack Finance)

Food prices are still a concern. (Bonddad Blog)

Why the government should undertake a massive infrastructure program. (Business Insider)

The 1% ain’t what it used to be. (The Atlantic)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Book reviews

Brenda Jubin, “If you read only one finance book this year, Aaron Brown’s Red-Blooded Risk: The Secret History of Wall Street![]() (Wiley, 2011) would be a good bet.”* (Reading the Markets)

(Wiley, 2011) would be a good bet.”* (Reading the Markets)

Daniel Kahneman’s Thinking, Fast and Slow![]() is “one of the five best books of the year.”* (EconLog)

is “one of the five best books of the year.”* (EconLog)

Mixed media

The rising value of a science degree. (Economix)

New York City taxi medallions now have a $1 million price tag. (Planet Money)

Another positive review of Margin Call. (NYTimes)

The new StockTwits iPhone app is live. (Howard Lindzon)

Abnormal Returns is a founding member of the StockTwits Blog Network.

*Amazon affiliate. You know the drill.