Quote of the day

Dan Loeb, “Looking at portfolios, think deeply about process over outcome. If you do something the right way enough times, you’ll win.” (Market Folly)

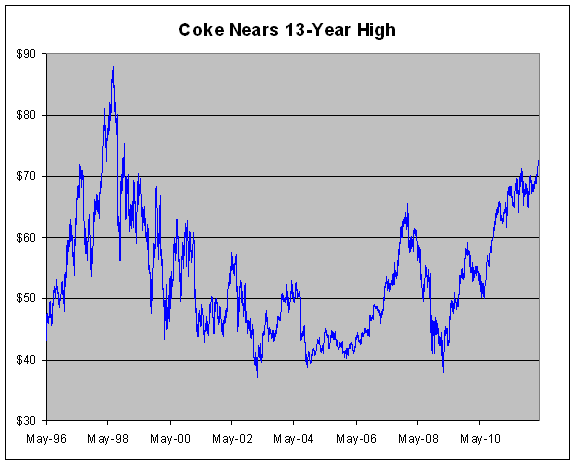

Chart of the day

Have a Coke and a thirteen-year drawdown. (Crossing Wall Street)

Markets

Momentum leaders continue to look constructive. (Ivanhoff Capital)

New highs are beginning to drop off. (All Star Charts)

Comparing two risk-on assets. (research puzzle pix)

How to think about options trading. (SurlyTrader)

Strategy

Ten golden rules for blowing out your trading account. (Brian Lund)

Failing traders often enter a “cycle of desperation.” (The Crosshairs Trader also TraderHabits)

On the disparity in risk taking among men and women. (Above the Market)

What lessons traders can learn from the “King of Blackjack.” (Mercenary Trader)

More evidence, this time from Germany, that individual investors greatly lag the market. (CXO Advisory Group)

Companies

A reality check on the valuation of Chipotle Mexican Grill ($CMG). (YCharts Blog, GigaOM)

Dan Loeb is in Yahoo! ($YHOO) for the long run. (Dealbook)

News Corp. ($NWS) wants to take ESPN head-on. (Bloomberg)

The case against Apple ($AAPL) stock, not the company. (Zero Hedge)

What does Warren Buffett see in Wal-Mart ($WMT)? (Insider Monkey)

Finance

In defense of sell-side analysts. (Interloper)

Wall Street does not get social media, part 253. (I Heart Wall Street)

Expect to see a lot more “general solicitations” from hedge funds. (Deal Journal, Dealbreaker)

Remember “sophisticated investors” aren’t necessarily all that sophisticated. (Total Return)

Wall Streeters really want to rub shoulders with CEOs, like Mark Zuckerberg. (Dealbreaker)

Startups

On the downside of crowdfunding for entrepreneurs. (Deal Journal)

FoundersCard: the “black card” for entrepreneurs. (CNNMoney)

How to avoid getting fired from your own startup. (peHUB)

ETFs

The ProShares UltraPro Short 20+ Year Treasury ETF ($TTT) launches. (IndexUniverse)

Naive attempts at hedge fund cloning are at-risk of failure. (Focus on Funds)

Coal

It’s hard for coal to compete against low natural gas prices. (Sober Look)

The effect of coal shipments on rail traffic. (ValuePlays)

Another way in which coal and fracking are in conflict. (Wonkblog)

Economy

Weekly initial unemployment claims continue to trend lower. (Calculated Risk, Bespoke, Capital Spectator)

Gross domestic income, or GDI, is showing some positive divergence from GDP. (Real Time Economics, FT Alphaville)

Is the US economy still accelerating? (Crossing Wall Street)

What are the regional Fed surveys saying about manufacturing activity. (Calculated Risk)

Who captured the Fed? The banks. (Economix)

Earlier on Abnormal Returns

Congress trades, you pay. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Some overlooked trading books. (Mortality Sucks)

Jeff Bezos has found the Apollo 11 rocket boosters at the bottom of the Atlantic Ocean. (Wired)

Why Route 66 still matters to people. (Money & Co.)

Abnormal Returns is a founding member of the StockTwits Blog Network.