The Abnormal Returns holiday book giveaway, 2012 edition, is now live. Check out the details. Don’t miss out!

Quote of the day

Rick Ferri, “Low correlation between two asset classes does not guarantee risk reduction in the short-term. It may take decades for any benefit to become apparent.” (Rick Ferri)

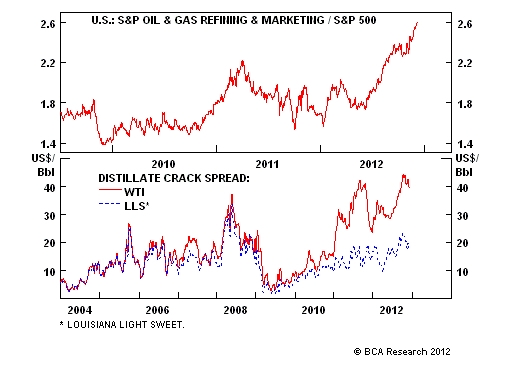

Chart of the day

US refiners have been on a tear. (BCA Research)

Strategy

Investors are often confused by about their time horizons. (NAS Trading via @derekhernquist)

The case for Oaktree Capital ($OAK). (Market Folly)

Black-Scholes is better than we think. (Condor Options)

Only in rare circumstances does diversification into VIX futures work. (Alea)

Companies

Apple ($AAPL) to begin manufacturing some Macs in the US. (NBC News also Asymco)

Song royalties are still a huge hurdle for music streamers like Pandora ($P). (WSJ)

How Netflix ($NFLX) is changing television. (GigaOM)

What VC-backed companies are worth more than $100 million? (Pando Daily, GigaOM)

Finance

Is Citibank ($C) deinternationalizing? (Felix Salmon)

What happens when the Transaction Account Guarantee program expires? (FT)

More evidence that investors bid up shares at quarter-end to boost performance. (WSJ)

How regulation led to high frequency trading. (NetNet)

On the ever changing definition of ‘pari passu.’ (FT Alphaville)

2012 has been a good year to be a CFO. (Businessweek)

Real estate

Accelerated prepayments have wreaked havoc on MBS investors this year. (FT)

Three big bankds originate half of the mortgages in the US. (Quartz)

At least John Paulson is doing well in real estate. (WSJ)

ETFs

Why is Michael Steinhardt selling WisdomTree Investment ($WETF) shares? (Institutional Investor)

Why currency ETFs never took off. (IndexUniverse)

Economy

A November employment report preview (and takedown). (A Dash of Insight, Crossing Wall Street)

Weekly initial unemployment claims decline. (Calculated Risk, Capital Spectator)

Tax withholdings surged in November. (Big Picture)

The ISM manufacturing and services indices have diverged. (Capital Spectator)

Will US oil consumption continue to decline? (Econbrowser)

Who owns more US debt: Japan or China? (Daniel Gross)

Mixed media

History is only run once: why social dynamics matter. (Cass Sunstein)

Having children reduces your risk of premature death. (The Atlantic)

There is no concussion crisis in football: there is an existential crisis. (Jonathan Mahler)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.