Quote of the day

Felix Salmon, “Weird things happen when you get deep into the weeds of high-frequency trading, a highly-complex system which breaks in entirely unpredictable ways.” (Reuters)

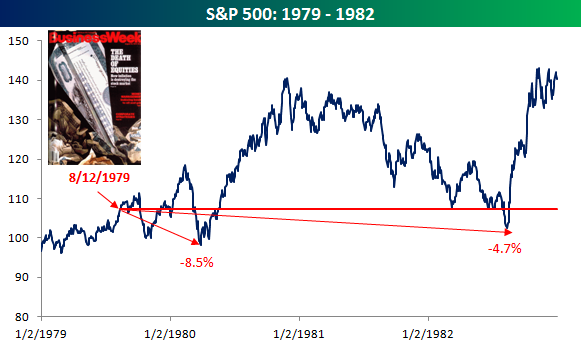

Chart of the day

How good was the now famous ‘Death of Equities‘ cover? (Bespoke)

Flash

Flash crashes are one reason individual investors feel the “deck is stacked against them.” (WSJ)

Do stops still work in a world dominated by algos? (Ivanhoff Capital)

How to trade in the age of algorithms. (Brian Lund)

Markets

Why in a world gone mad, equities are the only thing that make sense. (HuffingtonPost)

Beware calls about the “trade of the decade.” (Learn Bonds)

The consensus trade is exceedingly long the US dollar. (All Star Charts)

Cattle prices are set to tank on higher feed prices. (WSJ)

Strategy

Momentum comes in many flavors: which do you prefer? (research puzzle pix)

In praise of a naive portfolio allocation strategy. (Tim Harford)

Beware pundits bearing price targets. (The Reformed Broker)

Companies

AIG ($AIG) is poised to once again be an independent company. (WSJ)

Why the iPhone 5 is such a big deal for Apple ($AAPL). (SAI)

Electronic trading

How much did Knight Capital ($KCG) lose yesterday? (Deal Journal, Dealbook)

Electronic trading was supposed to produce a level trading field. Today, not so much. (Points and Figures)

Are ETFs helping to increase market volatility? (TheStreet)

Finance

It’s now fashionable for former bankers to call for the breakup of their erstwhile employers. (Dealbook)

The sell-side is looking for additional ways to trade bonds. (Bloomberg)

Fidelity, and other managers like it, can’t make money on Facebook ($FB) and why that matters. (Leigh Drogen)

Funds

Big names don’t necessarily make for good returns. (The Reformed Broker)

The best small mutual fund company websites. (Mutual Fund Observer earlier Abnormal Returns)

Not all consumer/biotech ETFs are created equal. (IndexUniverse, ibid)

The biggest mutual fund company you’ve never heard of. (Forbes)

Global

From the silver lining department: a weaker Euro is helping European exporters. (WSJ)

How US states and Euro countries differ on solvency. (Pragmatic Capitalism)

The Indian economy runs on backup electrical power. (FT, ibid)

Economy

An employment report preview. (A Dash of Insight)

Dividend increases are slowing: what does it mean for the economy? (Political Calculations)

Initial claims are flattish. (Calculated Risk)

Good news: bandwidth is betting cheaper. (GigaOM)

The global manufacturing slowdown has hit US shores. (Tim Duy)

Earlier on Abnormal Returns

What books Abnormal Returns readers purchased at Amazon in July. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

The economics of Olympic success. (Grantland)

To catch a cheat: performance profiling coming to the Olympics. (Scientific American)

Abnormal Returns is a founding member of the StockTwits Blog Network.