Quote of the day

Douglas J. Skinner, “If dividends were puzzling in 1976, they are even more so today because companies can now return cash to stockholders using stock repurchases, which have at least two advantages over dividends.” (Bloomberg)

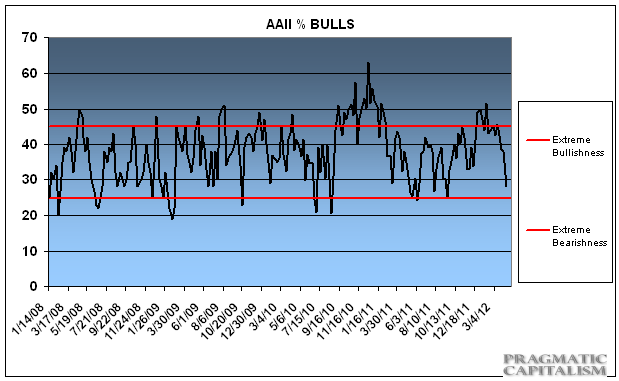

Chart of the day

Bullish sentiment is in retreat. (Pragmatic Capitalism)

Bonds

Another big name bond manager says buy stocks not bonds. (Income Investing, InvestmentNews via TRB)

Breaking down recent high yield bond issuance. (Sober Look)

Maybe there isn’t much to the low yield conundrum? (Institutional Investor)

It’s hard to trade bonds in isolation. (Tyler’s Trading)

The ten riskiest sovereign credits. (FT Alphaville)

Strategy

A simple strategy to time the $VIX. (MarketSci Blog)

What does “earnings volatility” imply for future equity returns? (SSRN)

Comparing ROIC vs. ROE as a measure of profitability. (YCharts Blog)

Does firm culture affect mutual fund returns? (Total Return)

Companies

Nordstrom ($JWN) is not going to lose the fight with online retailers sitting down. (Dealbook)

Even value investors are reluctant to sniff around Best Buy ($BBY) stock. (ContrarianEdge)

Delta Airlines ($DAL) is diving head first into fuel trading. (Fortune)

Apple

The short case on Apple. (Sum Zero)

How Apple ($AAPL) and the book publishers came to be in hot water. (MarketBeat, GigaOM, Forbes)

Finance

How to fix Legg Mason ($LM). (The Reformed Broker)

Blackrock ($BLK) is planning on launching its own bond trading platform this year. (WSJ, FT Alphaville, Dealbreaker)

More signs that risk is back on Wall Street. (Fortune)

Despite mediocre fund performance, the broader Fidelity is doing just fine. (Globe and Mail)

Economy

A big and unwelcome pop in initial unemployment claims. (Calculated Risk, Capital Spectator)

Is commercial loan growth a good sign for the economy? (Capital Spectator)

On the coming safe asset shortage. (FT Alphaville)

What the Instagram purchase says to the broader app economy. (Michael Mandel)

Whodathunk it? $2 natural gas reigns. (WSJ also All Star Charts)

Americans are getting older, faster. (Real Time Economics, Above the Market)

Earlier on Abnormal Returns

Putting the social in social finance: the historical role of TheStreet.com ($TST). (Abnormal Returns)

Things change. Don’t get caught in the trap of naively extrapolating the ERP using dusty old data. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Do we need a “Netflix of magazines“? (David Pogue)

How Uber is changing the market for car services. (Megan McArdle)

Abnormal Returns is a founding member of the StockTwits Blog Network.