Quote of the day

Michael Martin author of The Inner Voice of Trading*, “The world’s most successful traders seem to sleep with one foot on the floor every night. When they smell smoke, they assume it’s going to become a five-alarm fire very quickly and hence they cut losses. You can think more clearly when you are in cash, and out of the losing position.” (HuffingtonPost)

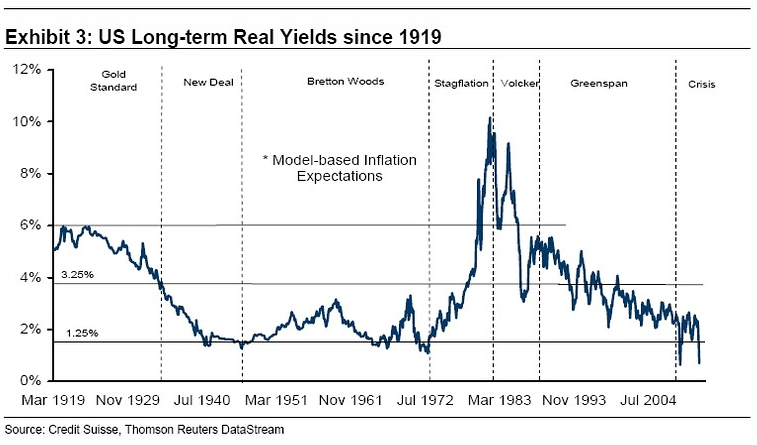

Chart of the day

The many implications of record low real interest rates. (MarketBeat)

Markets

How the S&P 500 has traded relative to forward P/E ratios. (Dr. Ed’s Blog also Big Picture)

What to make of the rise in high yield bond spreads. (Credit Writedowns)

The divergence that didn’t occur. (Market Anthropology)

Investor sentiment is bouncing around just like the market. (Bespoke)

What to look for in Q3 earnings. (Crackerjack Finance)

On the existence of an “FT effect.” (FT Alphaville)

Strategy

What are the true risks in your trades? (Adam Grimes)

Does the “sell in May” effect show up in hedge fund returns? (PerTrac)

Does the lunar cycle affect stock returns? (CXO Advisory Group)

Apple

Apple ($AAPL) continues to garner share in PCs. (Apple 2.0 also TechInsidr)

The long run in Apple stock came off of a very low base. (research puzzle pix)

Finance

A slowdown hits hard in the world of web start-ups. (WSJ also A VC, Term Sheet, GigaOM)

JP Morgan ($JPM) and its not altogether positive boost to earnings. (Kid Dynamite)

Why people feel they have been wronged. (The Psy-Fi Blog, Quint Tatro, TRB)

Another sign things are tough on Wall Street these days. (Deal Journal)

The dangers of state overview of small investment advisors. (InvestmentNews)

ETFs

The tax implications of the demise of HOLDRs. (IndexUniverse)

Alternatives to the top 20 ETFs. (ETFdb)

One the use of ETNs to invest in BDCs. (IndexUniverse)

Global

The BRIC exchanges are getting together. (beyondbrics)

Just how vulnerable are the various emerging markets. (beyondbrics)

Italian bond yields are signalling the crisis isn’t over. (Pragmatic Capitalism)

What should we make of the copper stockpile in China. (The Source)

Economy

The labor market is treading water. (Calafia Beach Pundit)

A long-awaited victory on free trade. (NYTimes)

Is the Fed unlucky or perfectly telegraphed? (Bespoke)

The economy, via the Chicago Fed National Activity Index, is in no man’s land. (Capital Spectator)

Operation Twist is running into a mortgage roadblock. (FT)

How much is the rising cost of health care to blame for the decline in the middle class? (The Atlantic)

Earlier on Abnormal Returns

The growing audience for dividends. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Social media

How to use StockTwits. Like all things in moderation. (Attitrade)

What you can learn from some one on Twitter. (AlphaTrends)

How I built my blog. (Aleph Blog)

FT Tilt is no more. (paidContent, Felix Salmon)

Mixed media

Do you really want to be a billionaire? (bclund)

Four strategy gurus to avoid. (HBR)

Big shocker, elite MBA students don’t want their grades disclosed. (Freakonomics, SSRN)

Abnormal Returns is a founding member of the StockTwits Blog Network.

*Amazon affiliate. You know the drill.