Quote of the day

Chris Arnade, “Rules are made to be gamed, and games are played to be won. That is at the core of the culture of Wall Street. If you don’t understand that, you don’t understand Wall Street.” (Guardian)

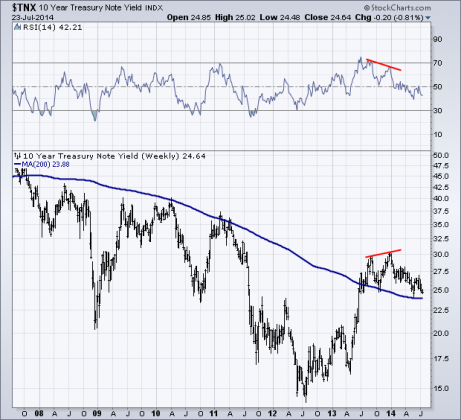

Chart of the day

Treasury yields have a hard time moving higher. (Andrew Thrasher)

Video of the day

Michael Mauboussin talks about The Success Equation: Untangling Skill and Luck in Business, Sports and Investing with the folks at Google. (YouTube via @pkedrosky)

Gold

On the relationship between long term Treasury yields and gold. (Market Anthropology)

A deep dive into a model that helps explain gold prices. (Crossing Wall Street)

Markets

Is China’s stock market ready to breakout? (Kimble Charting)

German bond yields are nearing Japan territory. (MoneyBeat)

As the market has risen bulls have headed for the door. (Bespoke)

Why volatility could stay low for awhile. (See It Market)

Strategy

William Bernstein in Rational Expectations: Asset Allocation for Investing Adults has become warier of “investing science.” (Rekenthaler Report)

The performance chase often ends in tears. (The Reformed Broker)

Why you should try and automate your investing as much as possible. (Patrick O’Shaughnessy)

There are a number of similarities between flying and investing. (The Flying Investor)

Momentum

On the value of combining different factors. (Humble Student)

Some momentum investing reads. (Capital Spectator)

Companies

Facebook ($FB) is becoming an mobile earnings machine. (WSJ)

Airline industry profits are attracting a new raft of startup competitors. (WSJ)

Hedge funds

Why investors are still willing to pay up for “alpha.” (the research puzzle also Barry Ritholtz)

Institutions are pouring money into hedge funds, except for Calpers. (CNBC, WSJ)

Finance

High frequency trader Jump Trading keeps a pretty low profile. (Bloomberg)

Legislation could retroactively punish tax inversion deals. (Dealbook)

What will asset managers need to do to comply with the new money market mutual fund rules? (Dealbook)

Buyout firms are trying to roll up the auto collision repair industry. (WSJ)

Now the Feds are getting into the farmland investment game. (NYTimes)

Economy

Weekly initial unemployment claims are at eight-year lows. (Calculated Risk, Bespoke, Capital Spectator)

Why the income for recent college grads have stagnated. (The Atlantic)

The recovery is starting to reach the long-term unemployed. (Wonkblog)

Earlier on Abnormal Returns

Six Essential Principles from Pragmatic Capitalism by Cullen Roche. (Abnormal Returns)

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Are all speed limits too low? (Priceonomics Blog)

We are not ready for a solar storm. (WashingtonPost)

A year in how Google Chromecast has changed our idea of television. (GigaOM)

Butter prices are at a 16-year high. (Bloomberg)

Millennials want no part of golf. (WSJ)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.