Quote of the day

Josh Brown, “Because everybody is calm and responsible and prudent and logical…Until the market rallies.” (The Reformed Broker)

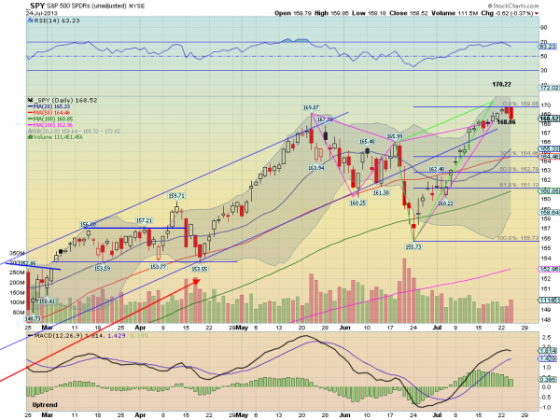

Chart of the day

The case for going short the S&P 500 ($SPY). (Dragonfly Capital)

Markets

Pros and amateurs have different opinions about this market. (chessNwine)

Many investors are still hanging out in cash. (WSJ see also Horan Capital)

The case for muni bonds. (IndexUnvierse)

Strategy

Forget alternatives, diversify across risk factors. (CBS News)

Correlations change. Get used to it. (Capital Spectator)

Few investors catch both sides of a boom/bust cycle. (Aleph Blog)

Companies

Facebook ($FB) surprised with a blowout quarter. (Pando Daily, Quartz)

What Charlie Munger has been up to at the Daily Journal ($DJCO). (Bloomberg)

The case for buying Barrick Gold ($ABX). (Focus on Funds)

Apple

A look at Apple’s biggest acquisition to-date. (Asymco)

The case for an Apple ($AAPL) rebound. (Market Anthropology)

A look at Apple’s long term P/E ratio. (Bespoke)

Provo, Utah is getting Google Fiber. (Pando Daily)

The new Gmail rules. (Slate)

The Google Chromecast sounds like a great deal. (Gizmodo, GigaOM, The Verge, BuzzMachine, Fast Company, BI, Quartz)

Finance

No one is making much money trading currencies these days, even the quants. (Bloomberg)

Some funny hedge fund marketing slogans. (Market Folly)

Funds

Don’t wait around for crummy funds to rebound. (Morningstar)

ETF failed trades recently spiked. (FT)

Economy

The US economy seems to be accelerating. (Business Insider)

Weekly initial unemployment claims have flattened out. (Calculated Risk)

Why isn’t corporate investment more robust? (Marginal Revolution)

How much excess housing inventory is still out there? (Avondale Asset)

Larry Summers doesn’t have much support from the blogosphere to be Fed chair. (Felix Salmon)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Why are Americans do down on the country’s prospects? A talk with Rick Newman author of Rebounders: How Winners Pivot from Setback to Success. (Daily Ticker)

Big Star shows how greatness need not translate into success. (Above the Market)

Can the Nest thermostat save the planet? (Daniel Gross)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.