Quote of the day

Erik Swarts, “Institutional managers during market extremes are rarely doing what they personally would advocate.” (Market Anthropology)

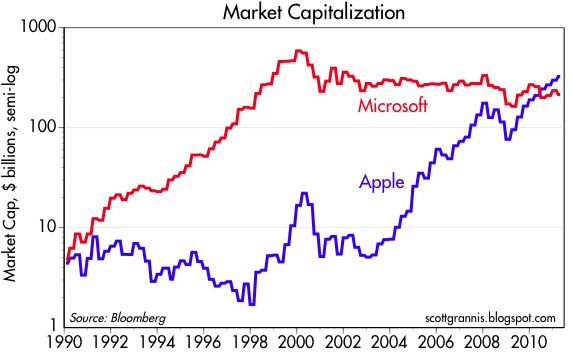

Chart of the day

A fascinating example of how things change over time. (Calafia Beach Pundit)

Markets

Will the bin Laden news serve as a market turning point? (Bespoke)

Bill Gross on where to look for AAA credits. (MarketBeat, Credit Writedowns)

Individuals are buying muni bonds, selling muni funds. (Businessweek)

Silver margin requirements are not out of whack. (Kid Dynamite)

The commodity giants are jumping on the agriculture fund bandwagon. (InvestmentNews)

Funds

John Hussman’s fund dances to the beat of a “different drummer.” (research puzzle pix)

The launch of the S&P CIVETS 60. (beyondbrics)

The Global X Food ETF (EATX) launches. (ETFdb)

Hedge funds are definitely back if institutions are heading back into small, startup funds. (Pensions & Investments)

Strategy

Peter L. Brandt, “An opinion is NOT a position. A position is NOT an opinion.” (Peter Brandt)

At the very least, a trader needs a plan. (Crosshairs Trader)

Where does ‘sell in May‘ fit into a broader strategy? (All Star Charts, Tyler’s Trading)

Research

What role does demographics play in secular market cycles? (Trader’s Narrative)

Why estimates of the equity risk premium are biased higher. (Falkenblog)

A slew of research papers on active investing. (World Beta)

Companies

Three reasons why eBay (EBAY) should spin-off PayPal. (TechInsidr)

The Gabelli guys like CVS Caremark (CVS). (24/7 Wall St. earlier AR Screencast)

How much does Apple’s cash hoard matter to its stock price? (Herb Greenberg)

Finance

Warren Buffett threw David Sokol to the SEC. (Dealbook)

The Feds are not happy with Deutsche Bank (DB). (Street Sweep)

NYSE Euronext (NYX) is no longer masters of their own fate. (Dealbook also WSJ)

How long before regulators start combing through tweets? (Minyanville)

American Idol-style investment contests are breaking out all over the place. (market folly, HFN)

China

China’s economy is huge. Does it really matter where it ranks on different measures? (Fundmastery Blog, CBS Moneywatch)

How does Longtop Financial Technologies (LFT) do it? (Bronte Capital)

Renren is coming to market. Facebook investors rejoice. (FT, peHUB)

Global

Interest rate differentials continue to work against the US dollar. (The Source)

How much more room does the Euro have to rally? (Investing With Options)

Who is going to pay for the ultimate Greek debt restructuring? (Felix Salmon, Money Game)

Economy

The month of April in economic statistics. (Capital Spectator)

Fuel prices are big part of inflation fluctuations. (Pragmatic Capitalism)

Earlier on Abnormal Returns

Cash is trash, until it isn’t. On the use of cash as a strategic investment option. (AR Screencast)

Check out what you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

How we get risk wrong. (Ezra Klein)

A list of Canada’s best finance blogs. (Globe and Mail)

Evidence that people are doing more reading on their mobile devices. (A VC)

The business school tuition bubble. (HBR)

Abnormal Returns is a founding member of the StockTwits Blog Network.