Quote of the day

Interloper, “The paralysis of Congress, an easy scapegoat for everyone, is in many ways just indicative of the cultural Mexican Stand-off in society at large.” (Interloper)

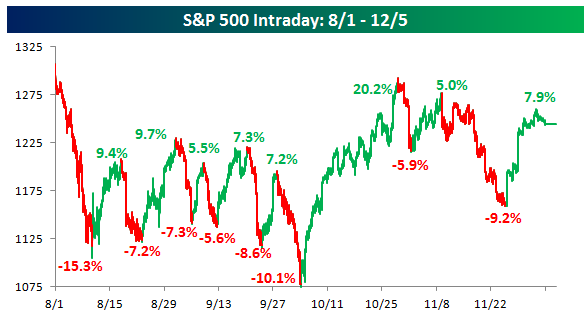

Chart of the day

Putting recent volatility into perspective. (Bespoke)

Markets

The markets for now is buying the talk coming out Europe. (MarketBeat)

The quick turnaround in market breadth. (Bespoke)

The relationship between forward earnings estimates and new factory orders. (Dr. Ed’s Blog)

Check out the wicked bear market in cocoa. (FT)

Tim Tebow and the wisdom of markets. (AbsoluteReturn+Alpha)

Strategy

The downside of dividends: underperformance in bull markets. (Total Return)

How to take advantage of mutual fund window dressing in December. (Mark Hulbert)

Ten dividend stocks the “ultimate stock pickers” are buying. (Morningstar)

“Bubble spotting” is a distraction for most investors. (Bucks Blog)

How good a job do REITs do in hedging inflation? (SSRN)

Megacaps

Why the market seems reluctant to pay up for Apple ($AAPL). (Felix Salmon)

On the megacap discount. (Aleph Blog)

Companies

Don’t forget about Yahoo’s ($YHOO) trove of patents. (Eric Jackson)

Is Oracle stock cheap? (Crossing Wall Street)

Acquisitive Oracle ($ORCL) should fear going the way of Ciscco ($CSCO). (Breakingviews)

Just how much is Facebook worth? (Time, SSRN)

Meet the most acquisitive companies in America in 2011. (Deal Journal)

Finance

Some one had to step up and lead the charge for MF Global customers. (Term Sheet)

Will Corzine take the fifth? (NetNet)

Ten years later how the implosion of Enron affected one exec’s finances. (Total Return)

This year’s bank stock performance is apparently all a part of an evil plan to boost compensation. (Dealbreaker)

Occupy Wall Street as the new jobs fair. (Dealbreaker)

ETFs

A year of ETF firsts in 2011. (ETFdb)

A frontier market version of the popular MSCI Emerging Markets Index Fund ($EEM) is on the table. (IndexUniverse)

A closer look at the PowerShares S&P 500 Low Volatility Portfolio ($SPLV). (AllETF)

The differences between some similar ETPs. (ETFdb)

Global

If Europe embraces austerity how will it ever get growing? (Free exchange, Finance Addict)

Why isn’t the Euro weaker? (Term Sheet)

Was the Euro a mistake from the get-go? (Planet Money, ibid)

Putting some numbers on redenomination risk. (FT Alphaville)

Investors in Russia don’t like political uncertainty. (beyondbrics)

Economy

Is it time to start worrying about $100 oil? (Business Insider also The Atlantic)

Improved Fed communications will make incoming data analysis easier. (Tim Duy)

The Fed defends its crisis lending. (Real Time Economics)

Falling home prices have helped lead to improved affordability. (Calculated Risk, Carpe Diem)

The relationship between current account deficits and the housing bubble. (FRBSF via EV)

Physics has a great deal to teach economics. (Bloomberg)

Earlier on Abnormal Returns

Inflation is still the silent killer of investor portfolios. (Abnormal Returns)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

A primer on cognitive dissonance. (Crosshairs Trader)

Why NBA owners won the lockout. (Freakonomics)

Abnormal Returns is a founding member of the StockTwits Blog Network.