Quote of the day

Michael Sivy, “But just as there has never been anything wrong with the Broadway Theater that a hit show wouldn’t fix, there’s nothing wrong with stocks that can’t be fixed by an economic recovery and a fresh bull market.” (Time)

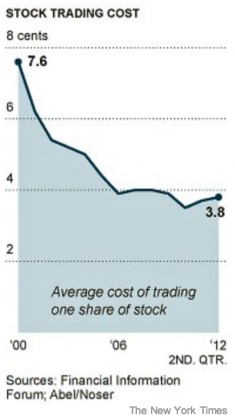

Chart of the day

The benefits of automated trading has leveled off. (NYTimes also Felix Salmon)

Markets

Q2 was filled with negative earnings surprises. (Sober Look)

What should we make of a quiescent $VIX? (Crossing Wall Street)

What if something goes right with the economy? (Calafia Beach Pundit)

When bonds don’t bite back. (Dealbreaker)

The dangerous allure of high yield muni bonds. (FT, Income Investing)

Strategy

Burton Malkiel on why investors can safely ignore flash crashes and the like. (WSJ)

Why investors can safely ignore most coverage of earnings reports. (Felix Salmon)

Don’t base your investments on who think is going to be President. (A Dash of Insight, Mark Hulbert)

Personal finance

The only financial disclaimer you will ever need. (The Reformed Broker)

You probably have too much stuff. (Carl Richards)

What insurance do actuaries buy? (Aleph Blog)

Research

Trend Following, Risk Parity and Momentum in Commodity Futures. (SSRN via @quantivity)

Market Timing with Moving Averages. (SSRN via @quantivity)

Companies

Pfizer ($PFE) files to sell a 20% stake in its animal health business. (Crossing Wall Street, Dealbook)

Jana Partners is now picking on fertilizer firm Agrium ($AGU). (WSJ, Globe and Mail)

With it’s Frommer’s deal Google ($GOOG) keeps adding non-algorithmic content. (WSJ)

Groupon’s ($GRPN) growth keeps decelerating. (WSJ, SAI, YCharts Blog)

Don’t shed a tear for former Presidential candidate, John Huntsman. (footnoted)

What to make of rampant Apple ($AAPL) iPhone leaks. (Slate also SplatF)

Investing

Investors are chomping at the bit to buy distressed assets in Europe. (Bloomberg)

Be wary: KKR ($KKR) and Goldman Sachs ($GS) want your money. (WSJ)

Maximizing shareholder value does not mean maximizing short term profits. (Falkenblog)

Finance

A twist on the incubator theme: investment bankers. (Dealbook)

Lower yields are squeezing insurance companies where it hurts. (MarketBeat)

The ten biggest IPOs in the pipeline. (Deal Journal)

When crowdfunding don’t forget the tax man. (peHUB)

ETFs

Low volatility is coming in all sorts of flavors now. (IndexUniverse)

The ETF Deathwatch for August is filled with actively managed ETFs. (Invest With an Edge)

Global

Tough times for short sellers in China. (FT Alphaville)

Australia’s banking sector is now worth more than Europe’s. (Pragmatic Capitalism)

What the breakup of the Habsburg Empire tells us about the Eurozone. (Wonkblog)

Economy

Retail sales surged in July. (Calculated Risk, Capital Spectator)

The “Lipstick Indicator” is flashing a warning sign for the economy. (Money Game)

Are foreclosure-related sales going to push house prices back down? (Calculated Risk)

Why worry about a “bubble” until you have an economic recovery? (Marginal Revolution)

Earlier on Abnormal Returns

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Sports

The football coach who doesn’t plan to punt this year. (Marginal Revolution)

Keenan Mayo, “Hard Knocks is only nominally about the action on a football field. It’s a show about powerful people running a high-speed, lucrative business…” (Businessweek)

The 25 best sports movies of all time. (Paste Magazine)

Abnormal Returns is a founding member of the StockTwits Blog Network.