Quote of the day

Steve Randy Waldman, “We are in a depression, but not because we don’t know how to remedy the problem. We are in a depression because it is our revealed preference, as a polity, not to remedy the problem. We are choosing continued depression because we prefer it to the alternatives.” (Interfluidity)

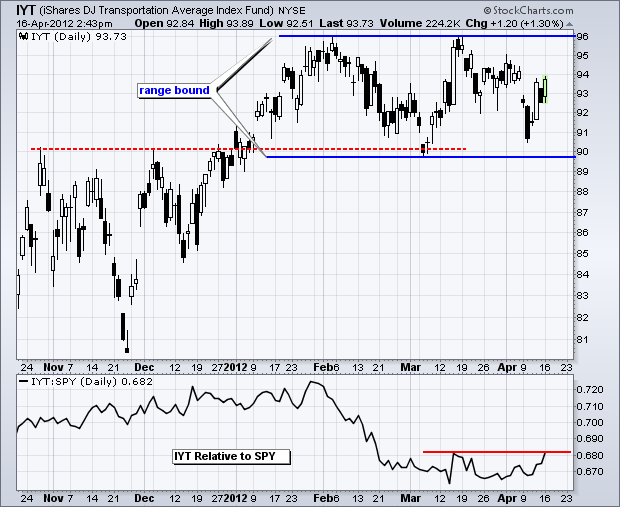

Chart of the day

Transports are trading in a range. (StockCharts Blog)

Markets

Stocks have traded in tandem with economic strength. (VIX and More)

The case for 10 more years of low returns. (StreetTalk Live)

The ten biggest share buyback announcements YTD. (Ticker Sense)

Strategy

Why forecasting risk is a lot easier than forecasting returns. (Portfolio Probe)

The business of giving financial advice is a complicated thing. (Random Roger)

The confusion between adviser and salesman still reigns. (Nerd’s Eye View)

Asset allocation

Is it possible to make money management TOO simple? (I Heart Wall Street)

The curse of the Yale Model. (Rick Ferri)

Another asset allocation ETF joins the fray. (IndexUniverse)

Some asset allocation research reading. (Capital Spectator)

Companies

Why Wellpoint ($WLP) trades at a discount to the HMO group. (Market Folly)

Do Google ($GOOG) shareholders really want to give up control in perpetuity? (Dealbook)

Did the Instagram deal catch the top in Apple ($AAPL)? (All Star Charts)

The Catch-22 of investing in alternative energy. (Sober Look)

The Carlyle Group ($CG) is going to be selling shares to an audience skeptical of publicly traded private equity shops. (WSJ)

Finance

The biggest news out of Goldman Sachs ($GS) is that they hike their dividend. (Crossing Wall Street)

Are quiescent default rates a function of QE? (FT Alphaville)

What “The Whale” may actually be accomplishing with his big bets. (NetNet)

Hedge funds

Are you ready for a wave of hedge fund advertising? (WSJ, Above the Market)

How the business of hedge fund of funds has changed. (Institutional Investor)

Just how dependent are hedge fund returns these days on the equity market returns. (Market Folly)

Hedge funds are combing through social media data for an edge. (Focus on Funds)

Metals

Is is finally time to get interested in the gold miners? (Stock Sage)

What have we done so long without a physical copper ETF? (IndexUniverse)

Global

Four trends in central banking. (FT Alphaville)

Can Europe alter its social contract the way Germany did? (Bloomberg)

Argentina is likely to expropriate itself to poverty, not wealth. (Free exchange also The Source)

Economy

Mixed messages on the new housing front. (Capital Spectator, Calafia Beach Pundit)

Why hasn’t multi-family starts surged even more? (Modeled Behavior)

Industrial production was flat in March but prior months revised higher. (Calculated Risk)

Ruchir Sharma author of Breakout Nations highlight a few countries poised for success. (Daily Ticker)

Earlier on Abnormal Returns

Check out this recent interview I did with Michael Martin as a part of the Abnormal Returns book tour. (MartinKronicle)

We were mentioned in this list of “101 Finance People You Have to Follow on Twitter.” (Clusterstock)

Abnormal Returns goes global. We were mentioned in this Swiss list of “blogs to follow.” (Bilan via TRB)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Consumer

Exploring the reasons why we buy what we do. (Bucks Blog)

30 days with a new iPad. (SplatF)

This is just great. Amazon has a “spam book” problem. (Fortune)

Why do restaurants seem to decline over time? (Slate)

Abnormal Returns is a founding member of the StockTwits Blog Network.