Quote of the day

Carl Richards, “If you think that dollar-cost averaging will help you deal with the emotional risk of investing, go ahead and do it.” (Bucks Blog)

Chart of the day

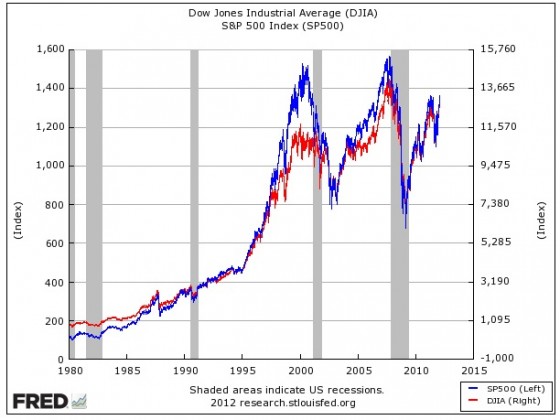

Stop dissing the Dow. (Money Game)

Markets

Since 1962 the spread between the earnings yield on the S&P 500 and the 10-year Treasury has never been higher. (Bloomberg)

The double top in long term Treasuries. (The Reformed Broker)

One of these days cash-rich companies will up their dividends. (FT)

Strategy

The value of highly levered firms is dependent on the state of the credit markets. (Distressed Debt Investing)

Low volatility and commodity futures returns. (Falkenblog)

Success requires attention to detail. (Stock Sage)

Apparently our new economy is based on inexpensive tacos and expensive athletic wear. (YCharts Blog)

Finance

The Fed is writing new financial regulations largely behind closed doors. (WSJ)

How some brokers including E*Trade ($ETFC) stack up with consumers. (Total Return)

The world of finance is filled with wasted talent. (The Reformed Broker)

ETFs

The ultimate greater fool trade involving natural gas ETPs. (Kid Dynamite)

The four key drivers of $TVIX. (VIX and More)

A field guide to $VIX ETPs. (VIX and More)

Global

Greece has exposed the limitations of the Euro model. (Dealbook, FT, The Atlantic)

Does the world really need a new currency basket? (beyondbrics)

Economy

The Chicago Fed National Activity Index shows continued economic growth. (Capital Spectator)

Conflicting signals for inflation. (Carpe Diem, MarketBeat)

Why the US should apply the MLP/REIT model to infrastructure assets. (FT)

Midwest farm land prices surged in 2011. Don’t expect a repeat in 2012. (Big Picture Ag)

Earlier on Abnormal Returns

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

A rave review for Fred Stoller’s “My Seinfeld Year![]() .” (Big Picture)

.” (Big Picture)

The ultimate app for the “buy what you know” investor. (USA Today)

Hepatitis C kills more Americans than HIV. (Scientific American)

Abnormal Returns is a founding member of the StockTwits Blog Network.