Quote of the day

Carl Richards, “High-frequency trading isn’t about real life. It’s about Wall Street. It makes for an incredibly entertaining story, but it’s really just a distraction from the often boring work of making smart investing decisions.” (Bucks Blog)

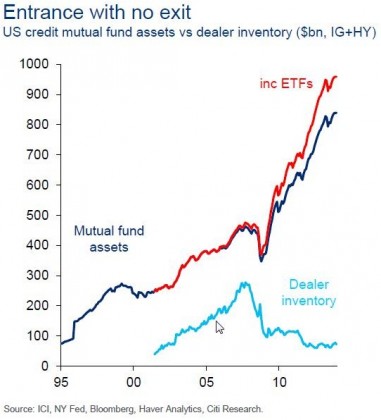

Chart of the day

On the divergence between credit ETF assets and dealer inventories. (FT Alphaville)

Markets

April is a typically a strong month. (Dynamic Hedge)

Value in the junk bond market is hard to find. (FT)

Why you should fear stock buybacks. (Fortune)

Notes from the 2014 Value Investing Congress. (Market Folly)

Strategy

Joshua Brown, “Remember – if investing or trading feels good, it’s probably being done wrong.” (The Reformed Broker)

On the dangers of backtest overfitting. (The Mathematical Investor via TraderFeed)

On the return premium for earnings quality. (ETF)

Companies

The mobile web is dying on the vine as apps take over. (Chris Dixon, A VC)

Content producers are throwing money at the YouTube ecosystem. (Pando Daily)

Is Netflix’s ($NFLX) business model broken? (SumZero)

Ranking the TV box strategies. (stratechery)

Twitter ($TWTR) is becoming more and more like Facebook ($FB). (Quartz)

Finance

Can the Box IPO withstand the pullback in the Nasdaq? (Quartz)

KKR ($KKR) wants a piece of the technology pie. (FT)

HFT and the economics of discount brokerage. (SL Advisors)

SEC lawyer says the SEC was too timid in going after Wall Street post-financial crisis. (Bloomberg)

Global

The idea behind the Cambria Global Value ETF ($GVAL). (ETF)

Five worrisome charts for the global economy. (Quartz)

German stocks have lagged of late. (MoneyBeat)

Economy

Small business optimism jumped in March. (Calculated Risk)

Slow business investment isn’t holding back the recovery. (Pragmatic Capitalism)

Good news: the US economy has a demographic tailwind. (Business Insider)

Markets at work: the value of a NYC taxi medallions has flattened out. (Pando Daily)

Earlier on Abnormal Returns

Recency bias in fund flows. (Abnormal Returns)

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

A good description of Bitcoin. (Business Insider)

Now even the lowly towel is getting disrupted. (TechCrunch)

The next wave of online shopping is greater personalization. (Slate, Washington Post)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.