Quote of the day

Herb Greenberg, “ETFs, or exchange-traded funds, which started as a sound idea but, with Wall Street being Wall Street, have all but turned into a monster.” (Google+)

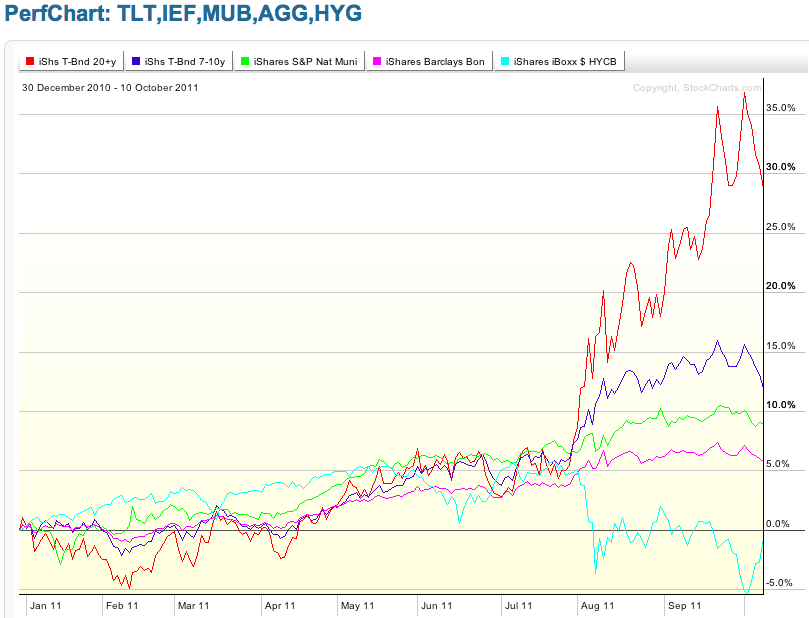

Chart of the day

The year in bond ETFs. (StockCharts)

Municipal bonds

Muni bonds are historically cheap relative to Treasuries. (Bond Buyer)

More target date muni ETFs are coming. (IndexUniverse)

Markets

A look at market internals. (All Star Charts)

A look at the best starts to October. (Bespoke)

The TED spread is creeping higher. (Minyanville)

Look to the deep cyclicals for confirmation of a market bottom. (Investing With Options)

Why is the price of prime mortgages declining? (FT Alphaville)

Strategy

Trading ‘V-type‘ bottoms is tough. (Tyler’s Trading)

Beware the safety of Treasuries. (Calafia Beach Pundit)

What type of value investor are you? (Distressed Debt Investing)

Why do “get rich quick schemes” continue to work? Because there is a ready market for them. (EconLog)

Equity risk premia around the world. (SSRN via CXOAG)

Companies

IBM ($IBM) is a new all-time high. (Crossing Wall Street)

iMessage could take a chunk out of the wireless business. (NYTimes)

The iPad continues to dominate the tablet market. (SplatF)

Calls for a break up Research in Motion ($RIMM). (Dealbook)

Desperate times in the oil tanker market. (Bloomberg)

What poor results at Cargill could mean for other commodity companies. (FT)

Finance

On the difference between puffery and fraud. (Dealbook)

Do Goldman Sachs ($GS) and Morgan Stanley ($MS) still want to be bank holding companies? (Term Sheet)

Wall Street is acting as headhunter for hedge funds. (Dealbook)

ETFs

The ETF Deathwatch for October 2011. (Invest With An Edge)

The worst performing ETFs year-to-date. (ETFdb)

Physical vs. futures-based commodity ETFs. (IndexUniverse)

Global

Giving China the benefit of the doubt. (Bloomberg)

Retail sales remain strong in China. (Crackerjack Finance)

A look at the industrial slowdown in Europe. (Dr. Ed’s Blog)

Visualizing the stress at Europe’s banks. (Global Macro Monitor)

Economy

Still waiting for some crowding out to occur. (Econbrowser)

The Cass Freight Index is at recovery highs. (Carpe Diem, CBP)

Karl Smith, “A rise in the price of oil in the face of a constant interest rate represents a tightening of monetary policy.” (Modeled Behavior)

Don’t expect a baby boom until the economy perks up. (Curious Capitalist, Freakonomics)

Small business optimism ticks up a bit. (Calculated Risk)

Earlier on Abnormal Returns

The solution to market-related noise. Block it. (Abnormal Returns)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

Investing in your career and your portfolio are two very different things. (Bucks Blog)

Food science is closing in on the “sweetness threshold” in cereals. (WSJ)

Abnormal Returns is a founding member of the StockTwits Blog Network.