Quote of the day

Roger Nusbaum, “Of all the valid strategies that you can name; one will be the best performer for the year, next five years and next ten years. One of those valid strategies will turn out to be the worst for those respective time periods but they are all still valid and can all help achieve long term financial success.” (Random Roger)

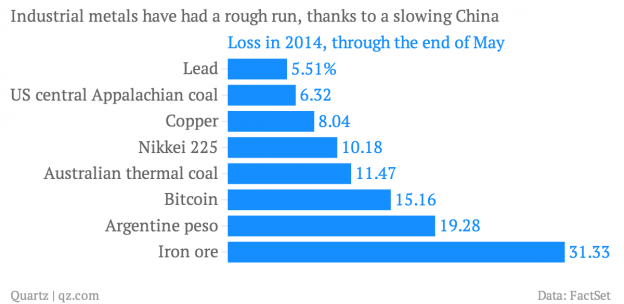

Chart of the day

The worst performing assets YTD. (Quartz)

Markets

When did the bull market actually start? (Price Action Lab)

Muni bond investors may soon have better a better information source. (WSJ)

Betting on a rise in shipping rates. (WSJ)

Strategy

It’s easy to forget about risk in a stable market environment. (Bucks Blog)

Three characteristics of successful market timers. (Morningstar)

Are dividends a value strategy? (Larry Swedroe)

Some of the best investing books ever, including Robert Hagstrom’s Investing: The Last Liberal Art. (Millenial Invest, TRB)

Business

Do pharmaceutical companies make money or drugs? (Dealbook)

Your local grocery store is likely to shrink. (Money)

Apple

An overview of what Apple announced at WWDC. (Wired, WSJD, Recode)

The Apple ($AAPL) at WWDC was “playful, hypercompetitive” and anxious to take on Google. (Vox)

HomeKit is Apple’s attempt to the physical world into another App Store. (The Atlantic)

Apple is now taking on Dropbox. (The Verge)

Some underhyped additions to iOS. (TechCrunch, Bloomberg)

Apple isn’t afraid to copy features from Android. (Business Insider, GigaOM)

TouchID will soon up the world of mobile payments. (Recode)

Finance

Meet the biggest hedge fund manager you have never heard of. (WSJ)

The hottest IPO of the past year may surprise you. (WSJ)

Funds

What is the “raw material” your fund uses to generate returns? (the research puzzle)

Why structure matters for leveraged ETPs. (ETF)

Comparing the Russell 2000 and S&P Small Cap indices. (WSJ)

How the First Trust Global Tactical Commodity Strategy Fund ($FTGC) has performed since launch. (ETF)

Global

How Alibaba is changing the face of Chinese finance. (Institutional Investor)

Is it obvious that the UK is in the midst of a housing bubble? (FT Alphaville)

Economy

More signs of life, including auto sales, in the American consumer. (Business Insider, ibid)

The fiscal drag is now easing. (FT Alphaville)

Why you won’t see “more new bridges” any time soon. (FiveThirtyEight)

The US used to be quite the industrial spy itself. (James Surowiecki)

Earlier on Abnormal Returns

Distracted, unsure and unfocused: why you should consciously structure your news consumption. (Abnormal Returns)

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

An interesting technique LinkedIn ($LNKD) CEO Jeff Weiner uses when providing feedback. (Business Insider)

Why The Colbert Report is so good. (The Daily Beast)

America loves bathrooms. (Vox, RTE)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.